Learn how to get your landlord to approve your dog with a proven strategy: show responsibility, offer a pet deposit, provide vet proof, and propose a trial period. Works in Auckland rentals.

The NC Extra Credit Grant helps first-time home buyers in North Carolina with up to 5% of the purchase price toward down payment and closing costs-no repayment required. Learn who qualifies, how it works, and how to apply.

Timeshares aren't free vacations - you pay monthly maintenance fees, often $100-$200, even if you never use the property. Learn what you're really signing up for and why most owners regret it.

Learn how to live harmoniously in a shared house with practical tips on splitting costs, setting rules, communicating effectively, and handling changes. Essential for anyone in shared ownership or co-living situations.

Student accommodation isn't yours for the whole degree. Learn the real rules on how long you can stay, what happens after graduation, and how to avoid being locked out.

Owning shares in a shared ownership home doesn't mean you're a full owner. You pay rent on part of the property, follow strict rules, and face barriers when selling or upgrading. Here's what it really means to own a share.

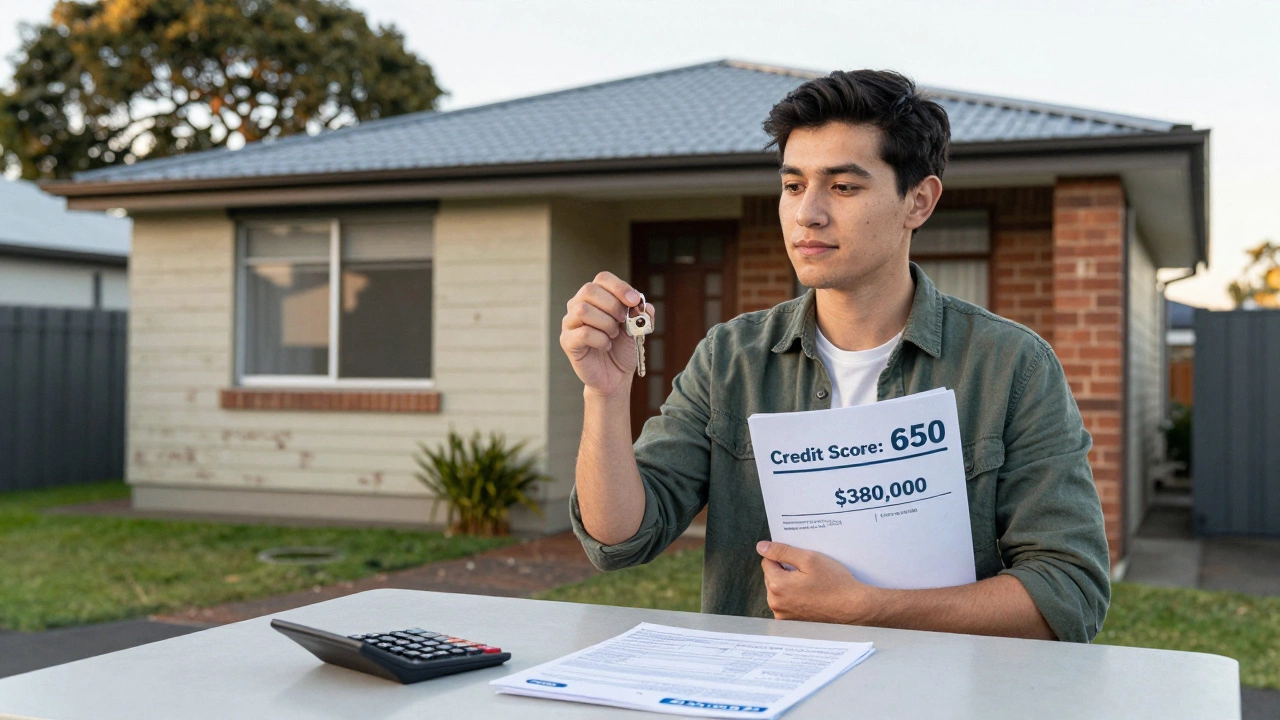

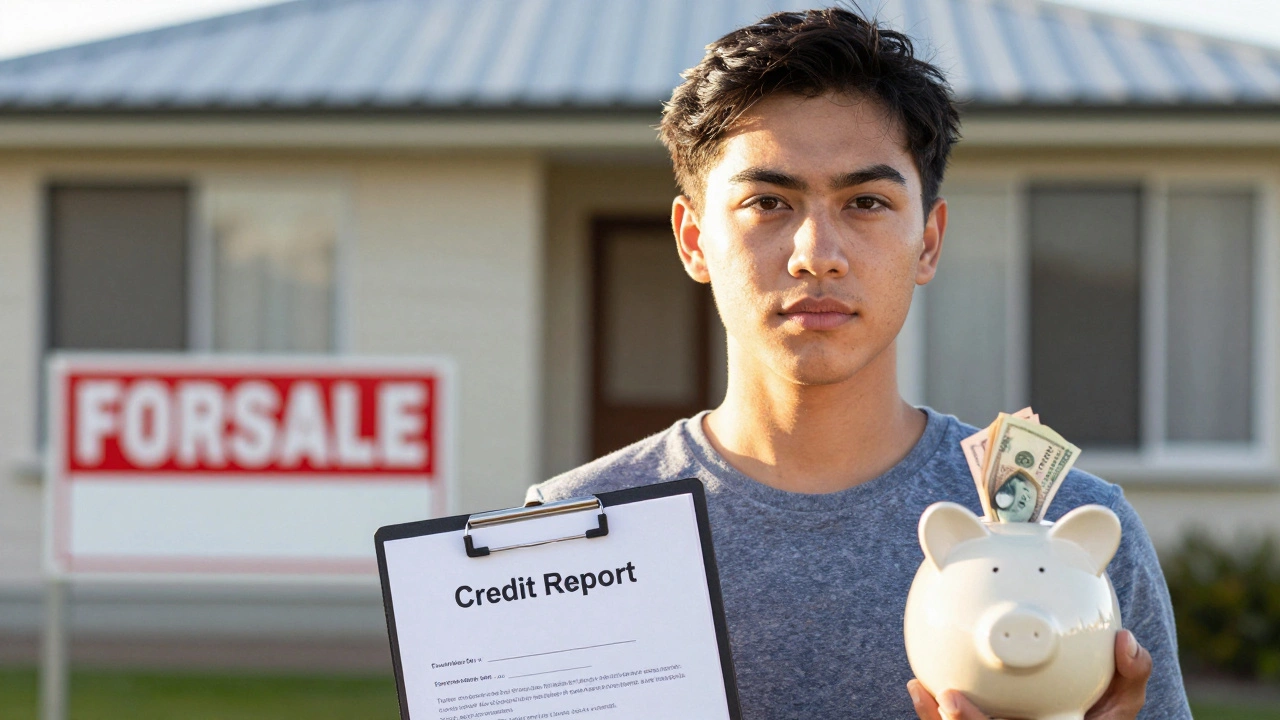

With a 650 credit score, first-time buyers in New Zealand can still get a home loan-but borrowing power is limited. Learn how much you can qualify for, what lenders look for, and how to improve your chances fast.

Learn how to accurately value a property using real sales data, location factors, and professional methods. Avoid common mistakes and understand what really affects home prices in today’s Auckland market.

Buy to let rent means buying property to earn income from tenants. It’s a long-term investment strategy that builds wealth through rental cash flow and property growth, especially in high-demand areas like Auckland.

Learn how to qualify as a first-time home buyer in Virginia with income limits, down payment help, credit requirements, and step-by-step guidance on accessing state programs.

A 900 credit score is possible in New Zealand, but it won't get you a better mortgage as a first-time buyer. Focus on saving a deposit and paying bills on time instead.

Choosing the right real estate agent to sell your house in Auckland can mean the difference between a quick, high-value sale and months of frustration. Learn what truly matters when picking an agent.