Home Loan Affordability Calculator

See how much you can borrow with a 650 credit score in New Zealand based on your income and debt.

With a 650 credit score, you may need a 15% deposit to avoid extra fees.

Check your credit report for errors - fixing them could improve your score by 30-70 points.

With a 650 credit score, you can still get a home loan in New Zealand-but you won’t get the best rates, and your borrowing power will be limited. If you’re a first-time buyer, this score puts you in the middle of the pack. It’s not bad enough to be turned down, but it’s not strong enough to give you breathing room. Most lenders in Auckland will approve you, but they’ll watch every dollar you spend. You’ll need to be smart about your budget, your deposit, and your debt.

What a 650 Credit Score Really Means for Your Mortgage

A 650 credit score falls into the ‘fair’ range in New Zealand. Lenders like BNZ, ANZ, and Westpac use this number to guess how likely you are to repay your loan. A score below 600 is risky. A score above 700 is safe. At 650, you’re in the gray zone. You’re not a deadbeat, but you’ve had some slip-ups-maybe a late payment, a maxed-out card, or a past default that’s now off your record.

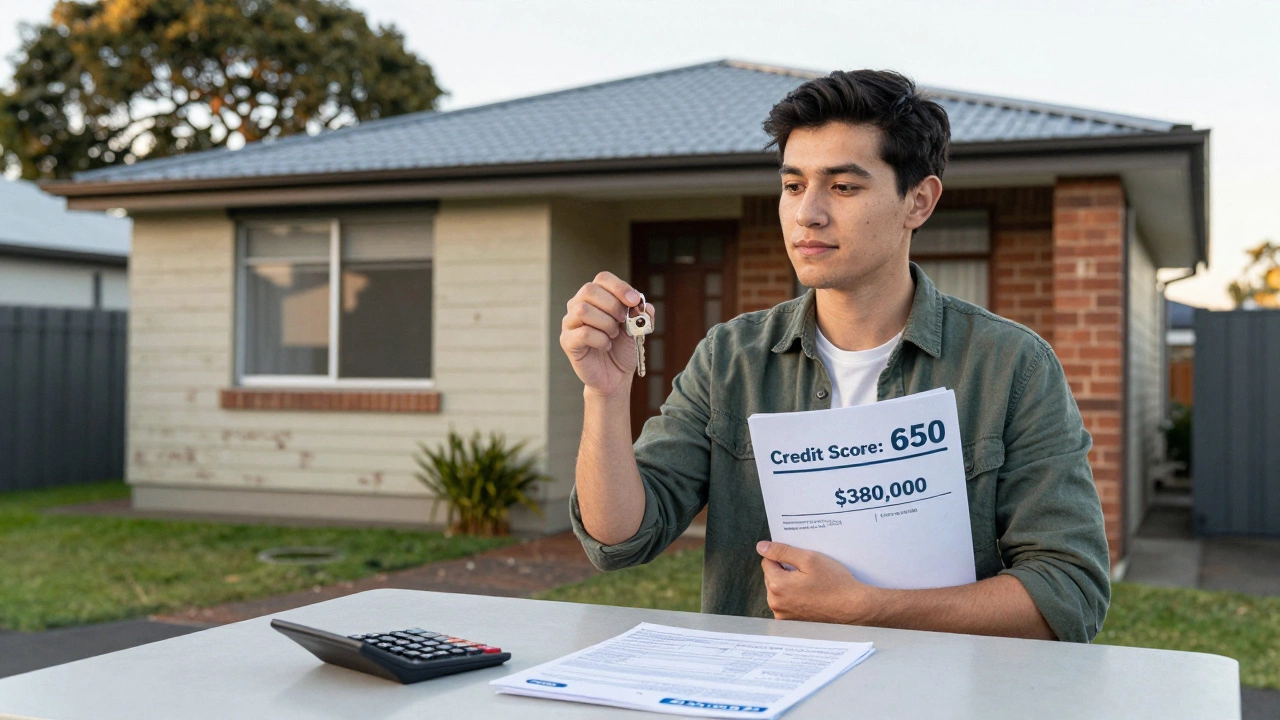

Here’s what that means in dollars: if you earn $70,000 a year, have $15,000 saved for a deposit, and no other debt, you might qualify for a loan around $380,000. But if you have a car loan or student debt, that number drops fast-to maybe $300,000 or less. Lenders use a formula called the debt-to-income ratio. They’ll add up all your monthly payments (rent, car, credit cards) and compare it to your income. If you’re spending more than 40% of your take-home pay on debt, you won’t get approved for much.

How Much Deposit Do You Really Need?

You don’t need 20% down in New Zealand anymore. The Reserve Bank relaxed rules in 2023, and most banks now let first-time buyers put down as little as 10%. But with a 650 score, you’ll be pushed toward the higher end of that range. Most lenders will want at least 15%-especially if you’re buying in Auckland, where prices are high.

For a $400,000 house, that’s $60,000 saved. If you’ve only got $30,000, you might need to look at homes under $300,000. That’s doable in suburbs like Manurewa, Papakura, or even parts of North Shore. But if you’re set on a house in Ponsonby or Takapuna, you’ll need to wait-or boost your credit score first.

There’s one trick: if you’ve got a parent or family member who can act as a guarantor, you might get approved with just 5% down. But that’s risky for them-and it’s not something lenders recommend unless you’ve got a rock-solid income and a clear plan.

Interest Rates and Costs You Can’t Ignore

With a 650 score, you’re not getting the 5.5% fixed rate everyone’s talking about. You’ll likely pay between 6.8% and 7.5%. That might not sound like much, but on a $350,000 loan over 30 years, it adds up to $115,000 more in interest than someone with a 750 score.

And that’s not all. You’ll probably face:

- Lender’s Mortgage Insurance (LMI) if your deposit is under 20%

- Higher application fees

- Stricter income verification

- Less flexibility if you want to refinance later

Some lenders, like SBS Bank or Co-operative Bank, are more forgiving than the big four. They’ll look at your whole picture-not just your score. If you’ve been steady at work for three years, have no recent defaults, and your bank statements show you’re saving consistently, they might give you a better deal.

What Lenders Look at Beyond Your Credit Score

Your credit score isn’t the whole story. Lenders dig into your bank statements, payslips, and even your spending habits. They want to see:

- Stable income-two years of employment, preferably with the same employer

- Low spending on credit cards-no maxed-out cards or frequent cash advances

- No recent late payments-especially in the last 12 months

- Minimal other debt-personal loans, HECS, car payments

- Consistent savings-showing you can handle monthly repayments

If you’ve got a 650 score because you missed a payment two years ago but have paid everything on time since, you’re in a much better spot than someone with the same score who’s still juggling three credit cards.

How to Boost Your Borrowing Power Fast

You don’t have to wait years to improve your chances. Here’s what works right now:

- Pay down credit card balances-aim to use less than 30% of your limit. If you’ve got $5,000 in credit and owe $4,000, pay it down to $1,500. That alone can jump your score by 30-50 points.

- Check your credit report-get a free one from Centrix or Equifax. Look for errors. Maybe a old bill you paid off still shows as unpaid. Dispute it. It takes 10-14 days to fix.

- Close unused accounts-having 5 credit cards you never use looks risky. Close the ones with no balance and low limits.

- Don’t apply for new credit-every hard inquiry drops your score a few points. Wait until after you’ve got your loan approved.

- Save more-every extra $1,000 in your deposit reduces your loan amount, which makes lenders feel safer.

One first-time buyer I spoke to in Manukau raised her score from 645 to 690 in six weeks by paying off $2,000 in credit card debt and disputing an old hospital bill that wasn’t hers. She got approved for $420,000-$70,000 more than her original quote.

What Happens If You Get Denied?

If you get turned down, don’t panic. It’s not the end. Most lenders will tell you why. If it’s because your debt-to-income ratio is too high, pay off a small loan or delay your purchase. If it’s your credit history, focus on rebuilding it for six months. Use a credit-builder loan or a secured credit card. Make every payment on time. Keep your balances low.

There are also specialist lenders who work with people who have lower scores. They’re not banks-they’re non-bank lenders like Homestead Finance or HomeStart. But they charge higher fees and interest. Only go there if you’ve exhausted all other options.

Realistic Expectations for First-Time Buyers

With a 650 score, you’re not going to buy a $700,000 house in Remuera. But you can absolutely buy a modest, well-located home in a growing suburb. You might need to compromise on size, age, or style-but you’ll own it. And that’s the point.

Many first-time buyers with scores like yours start with a 2-bedroom unit or a small section house. They fix it up over time. They build equity. Then, when their score climbs to 700+, they refinance and move up.

The goal isn’t to get the biggest house now. It’s to get into the market. Once you’re in, you can grow from there.

Can I get a home loan with a 650 credit score in New Zealand?

Yes, you can. Most banks in New Zealand approve first-time buyers with a 650 credit score, especially if you have a steady income, a deposit of at least 10-15%, and minimal other debt. You won’t get the best rates, but you’ll qualify.

How much can I borrow with a 650 credit score and $70,000 income?

With a $70,000 income, no other debt, and a 15% deposit, you could borrow around $380,000. If you have car or student loan payments, that number drops to $300,000-$340,000. Lenders cap your total debt at 40% of your income.

Do I need a 20% deposit with a 650 credit score?

No, but you’ll likely need at least 15%. Some lenders accept 10%, but they’ll charge Lender’s Mortgage Insurance and higher interest. A 15-20% deposit gives you better terms and avoids extra fees.

Will a guarantor help me get a bigger loan?

Yes. A guarantor-usually a parent-can help you qualify for a loan with as little as 5% deposit. But the guarantor is legally responsible for your repayments if you default. Only use this option if you have a solid job and repayment plan.

How long does it take to improve a 650 credit score?

You can improve it in 3-6 months by paying down credit card balances, fixing errors on your report, and avoiding new credit applications. Most people see a 30-70 point jump with focused effort.

Should I use a mortgage broker with a 650 score?

Yes. Brokers know which lenders are more flexible with lower scores. They can match you with non-bank lenders or smaller institutions that don’t rely only on credit scores. It’s free to use one, and it could save you thousands.

Next Steps: What to Do Today

Don’t wait for your score to be perfect. Start now:

- Get your free credit report from Centrix or Equifax.

- Check for errors and dispute them.

- Pay down any credit card balance to under 30% of your limit.

- Save an extra $500 a month toward your deposit.

- Book a free consultation with a mortgage broker who works with first-time buyers.

You don’t need a perfect score to own a home. You just need to be smart, patient, and ready to act. The market won’t wait-but your opportunity won’t vanish if you take the right steps now.

Corbin Fairweather

I am an expert in real estate focusing on property sales and rentals. I enjoy writing about the latest trends in the real estate market and sharing insights on how to make successful property investments. My passion lies in helping clients find their dream homes and navigating the complexities of real estate transactions. In my free time, I enjoy hiking and capturing the beauty of landscapes through photography.

view all postsWrite a comment