Virginia First-Time Home Buyer Down Payment Calculator

How Much Will You Pay?

See how much you could save with Virginia's first-time home buyer programs

Your Potential Assistance

Enter your home price to see results

Note: All assistance requires homebuyer education completion and must be for primary residence. Programs vary by county and income limits apply.

If you're trying to buy your first home in Virginia, you might feel like the system is stacked against you. Rising prices, strict lending rules, and confusing programs can make it seem impossible. But here’s the truth: Virginia has more help for first-time buyers than most states. You just need to know where to look.

What Counts as a First-Time Home Buyer in Virginia?

In Virginia, a first-time home buyer isn’t just someone who’s never owned a home. You can still qualify if you haven’t owned a home in the last three years. That includes people who:

- Owned a home before, but sold it more than three years ago

- Were only on a mortgage with a spouse who has since passed away or divorced

- Owned a mobile home or land but never a traditional house

The state doesn’t care if you’ve owned property overseas. Only U.S. residential property counts. So if you lived in Canada or Germany and rented, you’re still eligible.

Income and Credit Requirements

There’s no statewide income cap for first-time buyers, but most assistance programs do have limits. For example:

- Virginia Housing Development Authority (VHDA) sets income limits by county. In Fairfax County, a single person can earn up to $125,000. In rural counties like Buchanan, the limit is $95,000.

- Credit score requirements vary. Most VHDA loans accept scores as low as 640. Some local programs even work with scores in the 600s if you complete homebuyer education.

Most lenders still want to see a debt-to-income ratio under 43%. That means your monthly bills (mortgage, car payments, credit cards) shouldn’t add up to more than 43% of your gross income. If you make $6,000 a month, your total debt payments should be under $2,580.

Down Payment Assistance Programs

Virginia doesn’t require you to save 20% down. In fact, most first-time buyers put down less than 10%. Here’s what’s available:

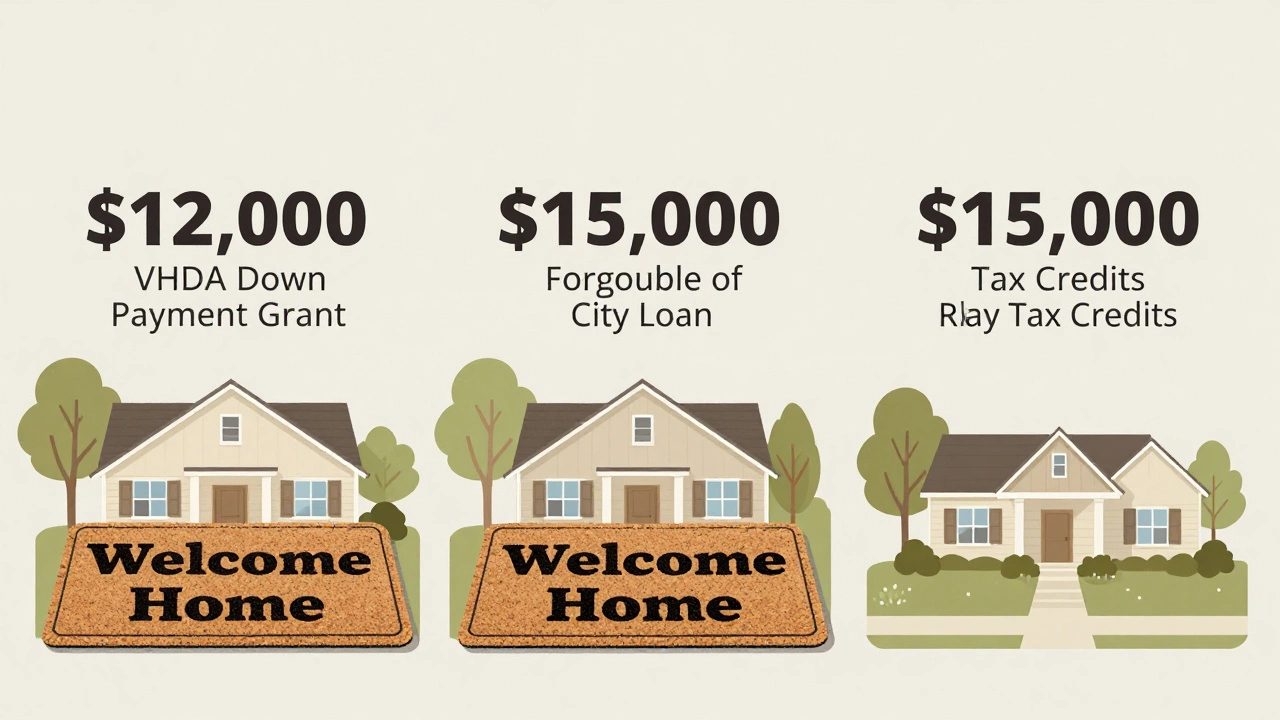

- VHDA’s HomeBuyer Program offers up to 4% of the loan amount as a down payment grant. You don’t pay it back. If you buy a $300,000 home, that’s $12,000 free money.

- Virginia’s First-Time Homebuyer Tax Credit lets you claim up to $2,000 per year on your state taxes for five years. That’s $10,000 total.

- Local city programs like Richmond’s First-Time Homebuyer Program offer up to $15,000 in forgivable loans. The loan disappears after you live in the home for five years.

These programs stack. You can combine VHDA’s down payment help with a local grant and the state tax credit. That means you could cover nearly 20% of your home’s cost without touching your savings.

Mortgage Options for First-Time Buyers

You don’t need perfect credit to get a mortgage in Virginia. Here are the most common paths:

- FHA loans: Require 3.5% down with a 580 credit score. Available everywhere in Virginia. Maximum loan limits range from $472,000 in rural areas to $720,000 in high-cost counties like Arlington.

- VA loans: If you’re active duty, veteran, or surviving spouse, you can buy with $0 down and no mortgage insurance. No income limits. Just need a Certificate of Eligibility.

- USDA loans: Available in eligible rural areas. $0 down, income limits apply (usually 115% of area median). Counties like Shenandoah and Wythe qualify.

- VHDA’s Conventional Loan: As low as 3% down, with mortgage insurance built into the rate. No income limits for this option.

Most first-time buyers in Virginia choose FHA or VHDA loans. They’re the easiest to qualify for and have the most support tools attached.

Homebuyer Education: It’s Not Optional

Almost every down payment assistance program in Virginia requires you to complete a homebuyer education course. This isn’t a formality-it’s a requirement. You can take it online for free through VHDA’s partner, Virginia Cooperative Extension.

The course takes about 6-8 hours. You’ll learn:

- How to read a loan estimate

- What closing costs really include

- How to avoid predatory lenders

- How to maintain your home after move-in

When you finish, you get a certificate. You need to submit this with your loan application. Some programs even give you a $500 bonus just for completing it.

What You Can’t Do

There are limits to protect the programs from abuse:

- You can’t buy a second home or investment property. The home must be your primary residence.

- You can’t use assistance for luxury homes. Most programs cap purchase prices at $550,000. In Arlington or Alexandria, the cap is higher-$720,000.

- You can’t combine multiple state grants for the same purpose. You can’t stack two down payment grants, but you can combine down payment help with a tax credit.

Also, don’t try to game the system. If you buy a home, then rent it out after six months, you’ll owe back all the assistance plus penalties.

How to Start the Process

Here’s a real step-by-step plan most successful first-time buyers follow:

- Check your credit report at AnnualCreditReport.com. Fix errors. Pay down credit card balances.

- Calculate your budget. Use a Virginia-specific mortgage calculator. Don’t assume you can afford what you see online.

- Take the free homebuyer education course. Get your certificate.

- Get pre-approved by a lender who works with VHDA. Not all lenders do.

- Work with a real estate agent who knows Virginia’s first-time buyer programs. They’ll know which homes qualify for grants.

- Apply for assistance at the same time you find a home. Don’t wait until closing.

Most people take 3-6 months from start to closing. Rushing leads to mistakes. Patience pays off.

Common Mistakes First-Time Buyers Make

Here’s what goes wrong-and how to avoid it:

- Mistake: Waiting to save 20% down. Solution: Use VHDA’s 3% down option. You’ll get better rates than a 20% down conventional loan.

- Mistake: Choosing the cheapest home. Solution: Look for homes in growing neighborhoods. A $320,000 home in Roanoke might be worth $400,000 in five years.

- Mistake: Not asking about closing cost help. Solution: Many programs cover up to $5,000 in closing costs. Always ask.

- Mistake: Using a friend who’s “in real estate.” Solution: Hire a licensed agent who specializes in first-time buyers. Ask for references.

What Happens After You Buy?

Getting the keys is just the start. Virginia requires you to live in the home for at least one year. After that:

- You can rent out rooms to help with payments.

- You can refinance after 12 months if your credit improves.

- You can sell at any time-but if you used a forgivable loan, you’ll owe a portion back if you sell before five years.

Many buyers use their first home as a stepping stone. They live in it for 3-5 years, build equity, then trade up. That’s the smart move.

Can I qualify as a first-time home buyer if I owned a home with my ex-spouse?

Yes, if you haven’t owned a home in the last three years. Even if you were on the title with a former spouse, you’re still eligible as long as you haven’t owned property in that time. You’ll need to provide proof of divorce or property transfer.

Do I need to be a Virginia resident to qualify?

Yes. Most programs require you to move into the home as your primary residence within 60 days of closing. You can’t use Virginia’s assistance to buy a vacation home or investment property. Proof of residency, like a Virginia driver’s license or utility bill, may be required.

Are there programs for first-time buyers with bad credit?

Yes. FHA loans accept credit scores as low as 580. Some local programs, like those in Norfolk and Richmond, work with scores as low as 600 if you complete homebuyer education. You’ll pay higher interest, but you can refinance later when your credit improves.

Can I use gift money for my down payment?

Yes. Most Virginia first-time buyer programs allow gift funds from family members. You’ll need a gift letter stating no repayment is expected. The donor must provide bank statements proving the money is theirs. Don’t use gift money from strangers-it raises red flags.

What if I make too much money to qualify for help?

Even if you earn above the income limit, you can still get a low-down-payment mortgage through VHDA’s conventional loan program. You won’t get a grant, but you’ll still get lower interest rates than standard loans. Many buyers in Arlington and Alexandria earn $150,000+ and still use VHDA for better terms.

Corbin Fairweather

I am an expert in real estate focusing on property sales and rentals. I enjoy writing about the latest trends in the real estate market and sharing insights on how to make successful property investments. My passion lies in helping clients find their dream homes and navigating the complexities of real estate transactions. In my free time, I enjoy hiking and capturing the beauty of landscapes through photography.

view all postsWrite a comment