Property Ownership Calculator

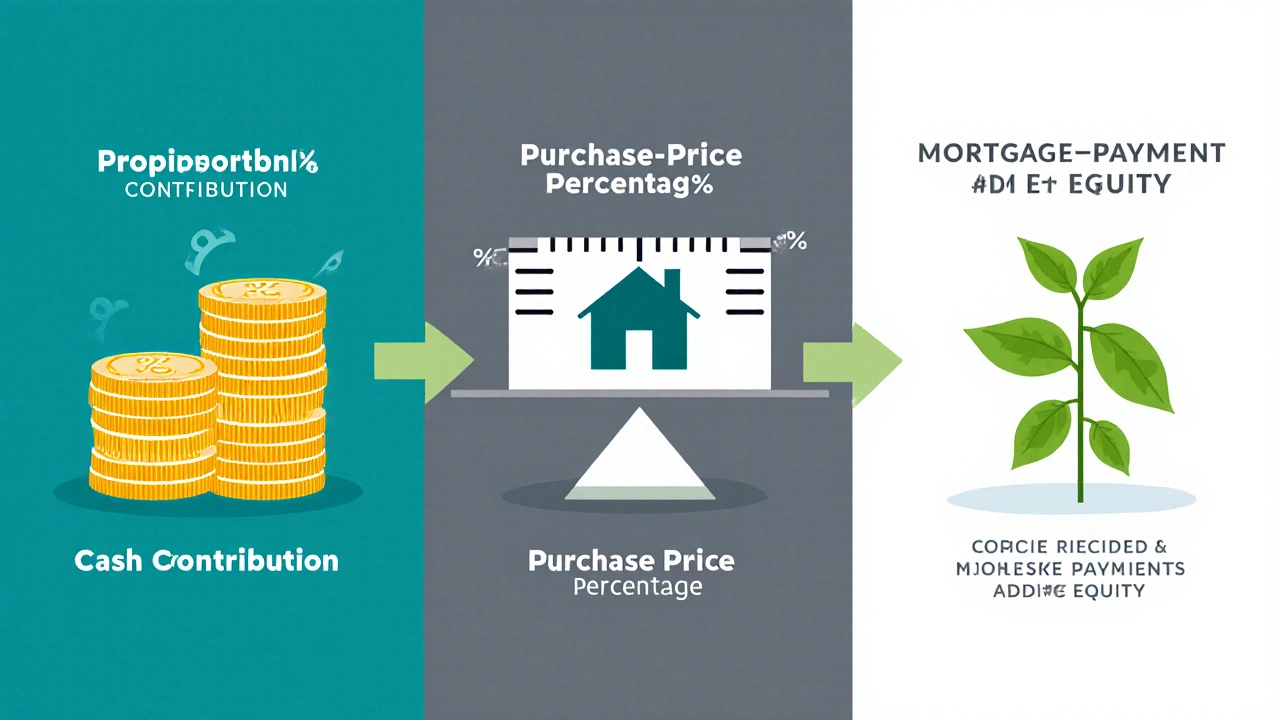

Proportional

Based on initial cash contributions only

Purchase Price

Based on contribution vs purchase price

Equity-Based

Includes ongoing mortgage payments

Ownership Breakdown

- Identify each partner's cash contribution and ongoing mortgage payments.

- Determine the current market value of the property.

- Choose a calculation method that matches your agreement.

- Apply the formula and record the result in the legal agreement.

- Re‑calculate when contributions change or the property appreciates.

When you and another person (or a group) buy a home together, you need a clear way to know who owns what slice of the building. That slice is called the share of ownership. Getting the math right protects everybody if you sell, refinance, or one partner wants out.

Key Concepts You Need to Know

Share of ownership is the percentage of a property that each co‑owner holds based on contributions, mortgage payments, and equity built over time.

Equity is the net value you have in the home after subtracting any debt from its market price.

Property value is the current market price of the home, usually obtained from a recent appraisal or comparable sales.

Capital contribution is the cash each party puts down at the time of purchase, often called the down‑payment.

Mortgage is the loan used to finance the purchase, which both parties may share or divide based on the agreement.

Legal agreement is the written contract (often a co‑ownership or partnership agreement) that records each party's share, responsibilities, and exit options.

Title deed is the official document that shows who legally owns the property and in what proportion.

Appreciation is the increase in property value over time, which can affect each owner's share if the agreement ties ownership to equity.

Step‑by‑Step: Calculating Share of Ownership

There are three common ways to work out each person's percentage. Pick the one that matches how you and your co‑owner decided to split costs.

1. Simple Proportional Contribution Method

- Add up all cash that each partner has put into the purchase (down‑payment, closing costs, any immediate renovations).

- Calculate each partner’s share by dividing their contribution by the total contribution.

- Result = (Individual contribution ÷ Total contribution) × 100%.

Example: Alice puts $30,000, Bob puts $20,000. Total = $50,000. Alice’s share = 30,000 ÷ 50,000 × 100% = 60%. Bob’s share = 40%.

2. Purchase‑Price Percentage Method

- Determine the agreed‑upon purchase price of the home.

- Divide each partner’s cash contribution (including their portion of the mortgage they plan to assume) by that purchase price.

- Result = (Individual contribution ÷ Purchase price) × 100%.

Example: Home costs $300,000. Alice pays $90,000 (including her assumed mortgage portion) and Bob pays $60,000. Alice’s share = 90,000 ÷ 300,000 × 100% = 30%. Bob’s share = 20%. The remaining 50% belongs to the lender until the mortgage is paid down.

3. Mortgage‑Payment Equity Method

- Start with the initial equity calculated by the first two methods.

- Each month, record how much of the mortgage payment goes toward principal for each partner.

- Add that principal amount to the partner’s equity.

- Re‑calculate the percentage: (Current equity ÷ Current property value) × 100%.

This method reflects the reality that whoever pays more of the loan builds more ownership over time.

Real‑World Scenarios

Two‑Person Purchase with Fixed Contributions

Emma and Liam each put $25,000 on a $250,000 house and split the mortgage 50/50. Using the simple proportional method, both own 50% right away. As they each pay half of the monthly principal, their ownership stays balanced.

Three‑Person Investment with Unequal Cash

Three friends buy a rental for $600,000. Contributions: $120,000, $80,000, $0 (one partner only provides labor). Using the purchase‑price method, shares start at 20%, 13.3%, and 0%. Over the next five years, the labor‑only partner receives a bonus of 5% equity each year for management duties, reflected in the mortgage‑payment equity method.

Changing Contributions Mid‑Loan

After two years, Sara decides to refinance and adds an extra $10,000 to the loan balance. The legal agreement should trigger a re‑calculation using the mortgage‑payment equity method, so Sara’s share grows proportionally to the new principal she assumes.

Common Pitfalls and How to Avoid Them

- Ignoring future appreciation: If the agreement ties ownership solely to cash contributions, one partner may feel short‑changed when the property’s market value shoots up. Include a clause that adjusts shares based on equity, not just cash.

- Forgetting to record mortgage principal splits: Many people track only the total payment, not the principal portion. Use an amortization schedule to see exactly how much each partner adds to equity each month.

- Over‑looking legal documentation: A verbal agreement is risky. Draft a formal co‑ownership contract, file the title deed with the appropriate shares, and have a solicitor review it.

- Not planning for exit scenarios: Define buy‑out formulas (e.g., current market value × ownership percentage) so that a departing partner‑can be paid fairly.

Quick‑Reference Checklist

- Get a recent professional appraisal → establish property value.

- Document every capital contribution with receipts.

- Choose a calculation method and write it into the legal agreement.

- Record monthly mortgage principal paid by each owner.

- Update the title deed after any ownership change.

- Review the share percentages annually or when major events occur (refinance, major renovation, sale).

Comparison of Common Calculation Methods

| Method | Complexity | Best For | Accounts for Mortgage Payments? | Reflects Appreciation? |

|---|---|---|---|---|

| Simple Proportional Contribution | Low | Flat cash splits, short‑term ownership | No | No |

| Purchase‑Price Percentage | Medium | When contributions differ from loan share | Partially (via assumed mortgage portion) | No |

| Mortgage‑Payment Equity | High | Long‑term co‑ownership, variable contributions | Yes (principal only) | Yes (if equity recalculated with market value) |

Next Steps and Troubleshooting

If you’re just starting, use the simple proportional method to get an initial split, then draft a legal agreement that allows you to shift to the mortgage‑payment equity method later. Should you discover a mismatch between recorded shares and actual equity, revisit the amortization schedule, re‑run the calculation, and file an updated title deed.

Common issues:

- Disagreement on contribution amounts: Use bank statements or escrow receipts as proof.

- Mortgage refinances change the principal: Re‑calculate shares at the moment of refinancing.

- Partner leaves early: Apply the buy‑out formula set out in the legal agreement-usually current market value × share percentage.

Frequently Asked Questions

Can I change my share of ownership after the purchase?

Yes. Any change should be documented in an amendment to the legal agreement and reflected on the title deed. Most owners recalculate using the mortgage‑payment equity method when extra cash is added or a partner takes on additional loan responsibility.

What if the property depreciates?

Depreciation reduces the overall equity, but each owner’s percentage stays the same unless the agreement ties share to market value. In that case, the percentages are recomputed based on the lower appraisal.

Do I need a lawyer for a co‑ownership agreement?

While you can draft a simple contract yourself, a solicitor ensures that the agreement complies with local property law, correctly records the title deed, and includes enforceable exit clauses.

How often should I recalculate the shares?

At least once a year, or whenever a major event occurs-refinance, large renovation, or a partner adds/withdraws cash.

Is it possible to have unequal shares but equal mortgage responsibility?

Yes. The agreement can specify that mortgage payments are split equally while ownership percentages follow cash contributions. This scenario is common when one partner has a higher income but wants a smaller equity stake.

Corbin Fairweather

I am an expert in real estate focusing on property sales and rentals. I enjoy writing about the latest trends in the real estate market and sharing insights on how to make successful property investments. My passion lies in helping clients find their dream homes and navigating the complexities of real estate transactions. In my free time, I enjoy hiking and capturing the beauty of landscapes through photography.

view all postsWrite a comment