First-Time Home Buyer Eligibility Checker

Check Your Eligibility

Determine if you qualify for North Carolina's first-time home buyer programs based on income, location, credit score, and ownership history.

Check Your Eligibility

Enter your details to see if you qualify.

If you’ve never owned a home before and you’re thinking about buying one in North Carolina, you’re not alone. Thousands of first-time buyers each year take this step-and many of them qualify for help they didn’t even know existed. But qualifying isn’t just about having a good credit score. It’s about understanding the specific programs, income limits, and rules that apply only to people buying their first home in this state.

What Counts as a First-Time Home Buyer in North Carolina?

In North Carolina, you don’t have to be a teenager or never lived in a house to qualify. The state defines a first-time home buyer as someone who hasn’t owned a home in the past three years. That means if you owned a house in 2022 but sold it in 2023, you’re still eligible in 2025. The same goes if you owned a home with a former partner or inherited property-you’re still considered a first-time buyer if you haven’t held title to a home in the last 36 months.

This rule applies to all state-backed programs, including the NC Home Advantage Mortgage™ and the NC Home Loan Program. Even if you’ve lived in a rental or with family, as long as you haven’t held a mortgage or deed in your name in the last three years, you’re in the clear.

Income and Purchase Price Limits

North Carolina’s first-time buyer programs aren’t open to everyone regardless of income. They’re designed to help moderate-income households get into homes, not to subsidize luxury purchases.

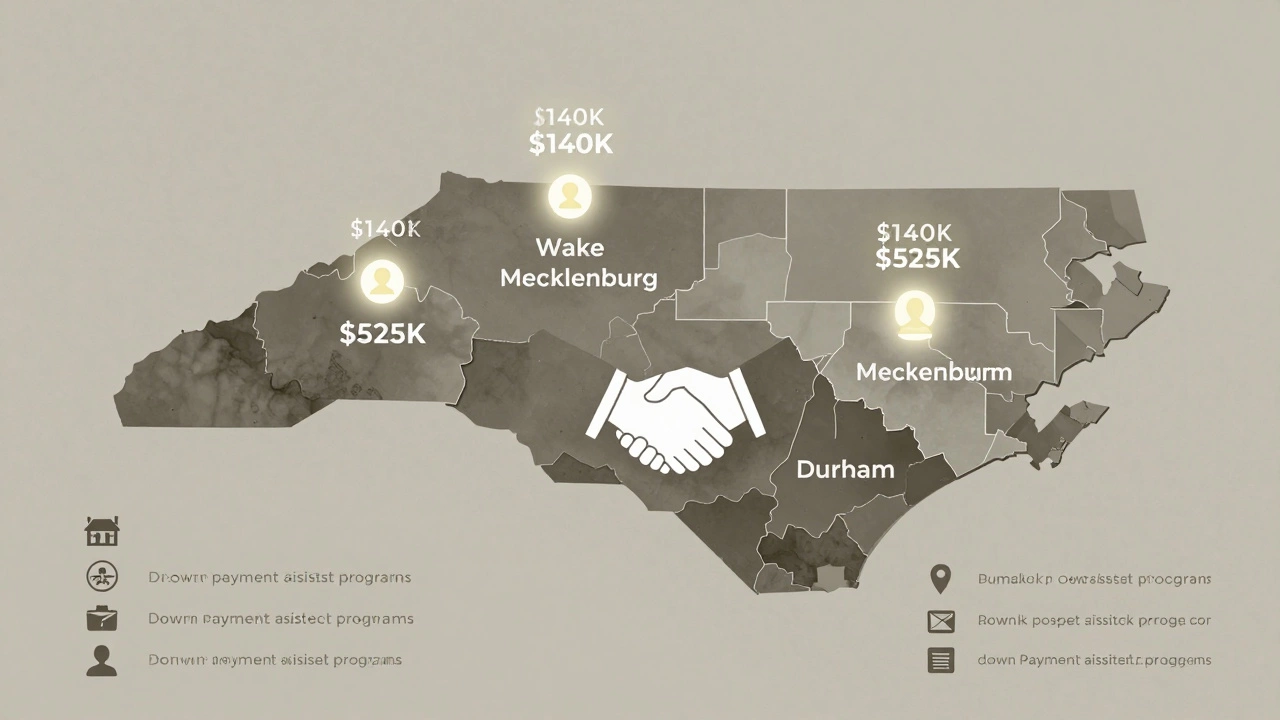

For 2025, the maximum household income limit for most programs is $125,000 in most counties. In high-cost areas like Wake, Mecklenburg, and Durham counties, the limit goes up to $140,000. These numbers are adjusted annually based on median income data from the U.S. Department of Housing and Urban Development (HUD).

There’s also a cap on the home’s purchase price. In most counties, you can’t buy a home priced above $450,000. In the same high-cost counties, the limit is $525,000. These caps ensure the programs help people buy homes that are truly affordable, not homes that cost more than $600,000.

Down Payment Assistance Programs

One of the biggest barriers to buying a home is saving for a down payment. Most lenders want at least 3% to 5%, but many first-time buyers struggle to save even that. North Carolina offers several down payment assistance programs that can cover up to 5% of the purchase price.

The NC Home Advantage Mortgage™ is the most popular. It combines a low-interest, fixed-rate mortgage with up to 5% in down payment help as a forgivable second mortgage. That means you don’t pay it back as long as you live in the home for at least five years. If you move or refinance before then, you pay back a prorated portion.

There’s also the NC Home Loan Program, which offers grants for down payment and closing costs. These are not loans-they’re free money. But you must complete a homebuyer education course first. The course takes about six hours and is offered online through HUD-approved providers like NeighborWorks America or local housing counselors.

Some counties offer extra help. For example, in Guilford County, first-time buyers can get up to $15,000 in assistance through the First-Time Homebuyer Program. In Buncombe County, the program matches your savings dollar-for-dollar up to $10,000 if you put in $5,000 of your own money.

Credit Score Requirements

You don’t need perfect credit to qualify. Many first-time buyer programs in North Carolina accept credit scores as low as 620. Some lenders even allow scores as low as 580 if you’re using an FHA loan backed by the federal government.

But here’s the catch: your credit score affects your interest rate. If your score is 620, you might pay 0.5% to 1% more in interest than someone with a 740 score. That adds up to hundreds of dollars a year. So while you can qualify with a lower score, improving your credit-even a little-can save you money long-term.

Check your credit report for free at AnnualCreditReport.com. Look for errors, late payments, or collections that shouldn’t be there. Disputing and fixing them can take 30 to 60 days, so start early.

Homebuyer Education Is Mandatory

If you want any state-funded down payment help, you must complete a homebuyer education course. This isn’t a formality-it’s a requirement. The course covers budgeting, credit, the home buying process, maintenance, and avoiding predatory lenders.

You can take it online through providers like:

- NeighborWorks America

- NC Housing Finance Agency (NCHFA)

- Local nonprofit housing counselors

Most courses cost between $50 and $100. Some counties offer them for free if you’re low-income. After you finish, you get a certificate. You’ll need to submit that to your lender or housing counselor to unlock any assistance.

What Types of Homes Can You Buy?

You can use first-time buyer programs to buy:

- Single-family homes

- Condos

- Townhomes

- Manufactured homes (if permanently affixed to a foundation)

- Multi-unit homes (up to four units, if you live in one)

You cannot use these programs to buy investment properties, vacation homes, or land without a home on it. The home must be your primary residence. You’ll need to sign a form confirming this when you close.

How to Apply

Here’s the step-by-step process:

- Check your income and the home price against the county limits.

- Get your credit report and fix any errors.

- Take a homebuyer education course and get your certificate.

- Get pre-approved by a lender who works with NCHFA programs. Not all lenders do-ask specifically if they offer NC Home Advantage or NC Home Loan.

- Find a home under the price limit in your county.

- Apply for down payment assistance through your lender or directly through NCHFA.

- Close on the home and move in.

It usually takes 60 to 90 days from start to finish. Don’t rush the process. Skipping steps like credit repair or the education course can delay your closing or disqualify you.

Common Mistakes to Avoid

Many first-time buyers in North Carolina make these mistakes:

- Applying for a loan with a lender who doesn’t offer state programs-this means you miss out on down payment help.

- Buying a home over the price limit because they think they can stretch their budget. The program won’t approve it.

- Waiting until the last minute to take the homebuyer course. It takes time to complete and get certified.

- Using gift funds from family without proper documentation. Lenders require a gift letter and proof the money came from the donor.

- Assuming they qualify because they’ve never owned a home. If they owned one in the last three years, they don’t.

One buyer in Charlotte thought she qualified because she’d never bought a house. But she’d inherited a condo in 2023. She lost her $10,000 grant because she didn’t know the three-year rule.

What Happens After You Buy?

Once you close, you’re responsible for property taxes, insurance, and upkeep. But you’re also building equity. And if you stay in the home for five years, any down payment assistance you received becomes yours to keep-no repayment needed.

Some buyers use the equity they build to refinance later or move up to a bigger home. Others stay for decades. Either way, the state’s programs are designed to help you get started, not just to get you through the first year.

Where to Get Help

If you’re unsure where to start, contact the North Carolina Housing Finance Agency (NCHFA). They don’t give out loans directly, but they work with over 100 lenders across the state who do.

You can also visit your local housing counseling agency. Most are nonprofit and offer free advice. In Raleigh, try the Capital Area Housing Partnership. In Greensboro, contact the Housing Authority of Guilford County.

Don’t rely on real estate agents alone. Many agents don’t know the details of state programs. Find a lender who specializes in first-time buyer loans-and ask them to explain every option.

Can I qualify as a first-time home buyer if I owned a home before 2022?

Yes. North Carolina defines a first-time home buyer as someone who hasn’t owned a home in the last three years. If you owned a home in 2021 or earlier, you still qualify in 2025. The key is the three-year look-back period, not whether you’ve ever owned before.

Do I need to be a U.S. citizen to qualify?

No. You don’t need to be a U.S. citizen, but you must be a legal resident with a valid Social Security number or Individual Taxpayer Identification Number (ITIN). Most programs require proof of legal presence, but citizenship is not required.

Can I use the program to buy a fixer-upper?

Yes, but only if the home meets minimum safety standards and you’re using a loan that allows for repairs. The NC Home Advantage Mortgage™ can be combined with an FHA 203(k) loan for homes needing repairs. The repairs must be planned before closing and approved by the lender.

Is there a limit on how many times I can use these programs?

No. You can only use them once-because you’re only eligible once. Once you’ve closed on a home using a first-time buyer program, you’re no longer considered a first-time buyer for future purchases. But if you sell and buy again after three years, you can qualify again.

What if my income goes up after I buy?

Your income at the time of application determines your eligibility. If you get a raise, change jobs, or earn more after closing, it doesn’t affect your loan or down payment assistance. The rules are based on your situation when you apply, not what happens later.

Next Steps

Start today. Get your credit report. Check your income against the limits for your county. Find a HUD-approved housing counselor. Take the course. Then talk to a lender who works with NCHFA. Don’t wait until you’ve found your dream home-get your paperwork in order first. The right program could save you thousands and turn your first home into a real investment, not just a monthly payment.

Corbin Fairweather

I am an expert in real estate focusing on property sales and rentals. I enjoy writing about the latest trends in the real estate market and sharing insights on how to make successful property investments. My passion lies in helping clients find their dream homes and navigating the complexities of real estate transactions. In my free time, I enjoy hiking and capturing the beauty of landscapes through photography.

view all postsWrite a comment