Timeshare Inheritance Cost Calculator

Calculate Your Timeshare Costs

Inheriting a timeshare means taking on ongoing financial obligations. This calculator helps you estimate annual costs and potential liabilities over time.

Results

Enter values above to see your estimated financial liability.

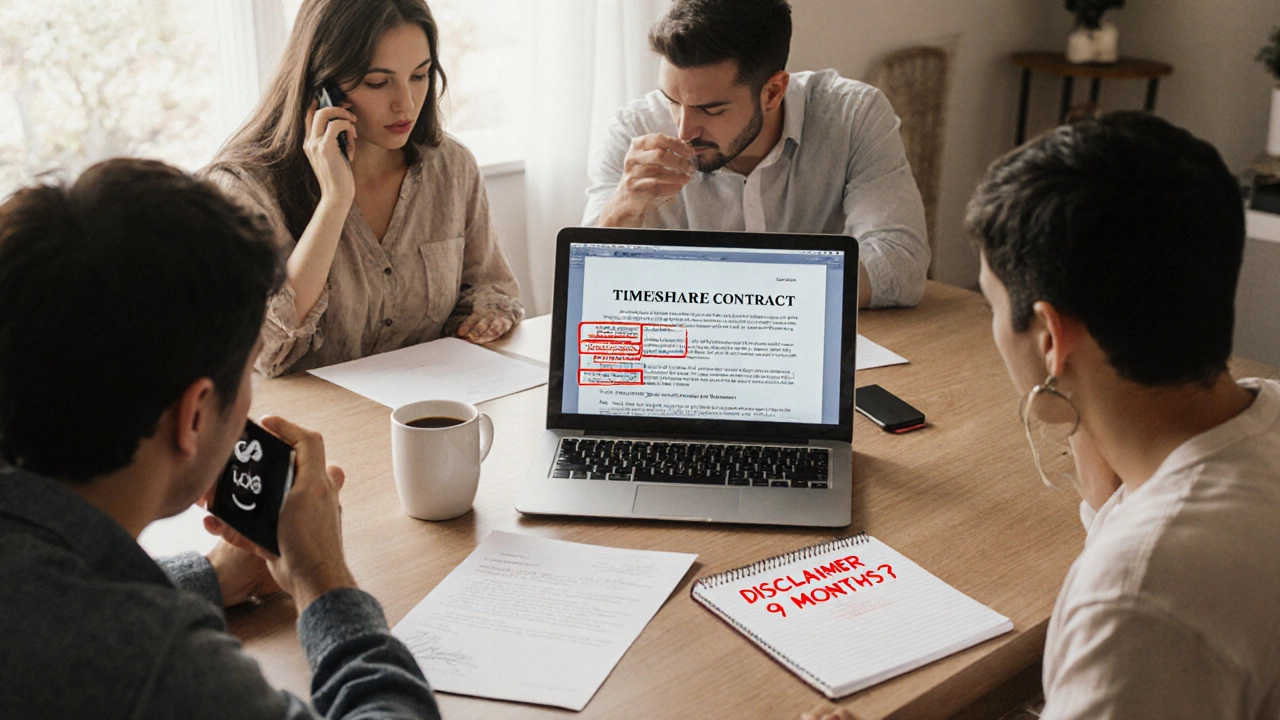

Important: You can legally disclaim the inheritance within 9 months of death to avoid these costs. This calculator helps determine whether it's worth pursuing.

This calculator provides an estimate of potential financial liability. Actual costs may vary based on your specific contract and location. Always consult with an estate attorney regarding your specific situation.

When a timeshare owner dies, the property doesn’t just vanish. It becomes part of their estate-and that’s where things get complicated. Unlike a regular home, a timeshare isn’t just an asset. It’s a contract with ongoing fees, maintenance costs, and restrictions. Many families are caught off guard when they learn they’ve inherited a timeshare they never wanted-and now owe money on it.

Timeshares Don’t Disappear With the Owner

A timeshare is a legal ownership interest in a property, usually for a set period each year. When the owner passes away, that interest doesn’t dissolve. It transfers to their heirs through their will, trust, or state intestacy laws if there’s no estate plan. The key issue? You don’t get to choose whether you inherit it. The contract stays active.

That means the new owner-whether it’s a child, spouse, or distant relative-now inherits the annual maintenance fees, special assessments, property taxes, and sometimes even debt from unpaid dues. These costs can add up to $1,000-$3,000 per year, depending on the resort and location. And unlike a house, you can’t just sell it easily. The resale market for timeshares is nearly nonexistent, with most selling for pennies on the dollar-or nothing at all.

What’s in the Timeshare Contract?

Most timeshare contracts include a clause that says ownership is “in perpetuity”-meaning it lasts forever unless you cancel it. That’s not a typo. Many people sign these contracts thinking they’re buying a vacation for a week each year. They don’t realize they’re signing a lifelong financial obligation.

When the owner dies, the resort management company doesn’t care if the family never plans to use the unit. They still send bills. And if those bills go unpaid, the account goes into default. That can lead to collections, credit damage, or even a lien on the estate. Some resorts have the right to pursue the estate for unpaid fees, even if the heirs never signed the original contract.

Here’s what most contracts require:

- Annual maintenance fees (non-negotiable)

- Special assessments for renovations or emergencies

- Property taxes (often passed to the owner)

- Exchange fees (if using points-based systems)

- Transfer fees (to change ownership after death)

Many families don’t realize these fees keep coming-even if the unit sits empty for years. And if the estate is probated, the executor is legally responsible for settling all debts, including timeshare obligations.

Can You Refuse to Inherit a Timeshare?

Yes-but only if you act fast and follow the right steps. In most U.S. states, heirs can disclaim an inheritance within 9 months of the owner’s death. This is called a “qualified disclaimer.” You must file it in writing with the probate court and the timeshare company before accepting any benefit from the property.

Here’s how it works:

- Do not use the timeshare, pay any fees, or accept any benefits from it.

- Get a legal disclaimer form from your state’s probate court or an estate attorney.

- Sign and notarize the disclaimer within 9 months of death.

- File it with the court and send copies to the timeshare management company.

Once filed, the timeshare passes to the next heir in line-or back to the resort if there are no other heirs. The estate is no longer liable. But if you wait too long, or if you use the unit even once, you lose the right to disclaim. And then you’re stuck.

What If There’s No Will?

If the owner died without a will, state intestacy laws determine who inherits the timeshare. Usually, it goes to the spouse, then children, then parents. But again-no one gets to choose. Even if the family hates the timeshare, the law still transfers it.

Probate can take months or even years. During that time, the timeshare fees keep piling up. The resort won’t pause billing just because the estate is tied up in court. And if no one steps forward to claim it, the resort may eventually take possession-but they won’t cover the back fees. Those still belong to the estate.

One real case from Florida involved a woman who inherited her father’s timeshare. She didn’t know it existed until she got a collection notice for $12,000 in unpaid fees. She tried to disclaim it-but waited 11 months. The court denied her request. She ended up paying $8,000 to settle the debt and then spent another $2,000 to transfer the title to a nonprofit that accepts unwanted timeshares.

How to Plan Ahead

The best way to protect your family is to plan before you die. If you own a timeshare:

- Include it in your will or living trust

- Clearly state whether you want it passed on or disposed of

- Leave instructions for paying or canceling the contract

- Consider buying a timeshare cancellation service (some are legitimate)

- Keep a list of all your contracts with contact info for management

Some estate planners recommend selling the timeshare while you’re still alive-even at a loss. Others suggest donating it to a charity that accepts timeshares (though few do). There are also companies that specialize in helping owners exit timeshares legally. But be careful: many are scams. Look for firms with A+ ratings from the Better Business Bureau and no upfront fees.

What the Resort Will Do

Timeshare companies don’t want to lose money. When an owner dies, they’ll send letters to the estate’s executor. If no one responds, they’ll escalate. Some send notices to the next of kin. Others hire collection agencies. A few even file claims against the estate in probate court.

They know most families don’t know their rights. That’s why they don’t offer easy exit options. The goal is to keep the fees flowing. If the estate pays, great. If not, they’ll wait. And wait. And wait-until someone finally gives in.

Don’t be fooled by promises of “free exit” programs. Most are marketing traps. Legitimate exit services charge $3,000-$7,000 and take 6-18 months. They work by negotiating with the resort to release you from the contract. But they can’t force the resort to agree. And they can’t erase past due balances.

What to Do Right Now

If you’re dealing with a deceased relative’s timeshare:

- Stop making payments. Don’t assume you’re responsible until you know your legal options.

- Find the original contract. Look for the management company’s contact info.

- Contact the probate court. Ask how to file a disclaimer if you want to refuse the inheritance.

- Consult an estate attorney. Most offer free initial consultations.

- Don’t sign anything from the resort without legal review.

Many people panic and start paying out of guilt or fear. But paying doesn’t make you the owner. It just makes you the payer. And you’re not legally required to pay unless you formally accept the inheritance.

Final Reality Check

Timeshares are not investments. They’re expensive vacation memberships with no resale value. When the owner dies, they become a financial burden on the family. The only way to avoid disaster is to plan ahead-or know your rights when it’s too late.

If you’re inheriting a timeshare, you have options. But you have to act quickly. Don’t wait for a bill to arrive. Don’t assume someone else will handle it. And don’t let guilt make you pay for something you never wanted.

Can I just ignore a timeshare after the owner dies?

No. Ignoring it won’t make it go away. The resort will keep sending bills. If unpaid, the debt may go to collections, damage the estate’s credit, or lead to legal action. You must either accept the inheritance, disclaim it within 9 months, or work with an attorney to resolve it.

Do I have to pay the maintenance fees if I don’t use the timeshare?

Yes-if you inherit it. The contract binds the owner, not the user. Even if you never set foot in the unit, you’re still responsible for annual fees, taxes, and assessments. The only way out is to legally disclaim the inheritance before accepting any benefit.

Can a timeshare be sold after the owner dies?

Technically yes, but practically it’s very hard. The resale market is flooded with unwanted timeshares, and most sell for less than $500-or nothing. Some companies claim they’ll buy it, but they often charge high fees or offer far below value. Selling through the resort is rarely an option unless they have a buyback program.

What if the timeshare is in another country?

International timeshares follow the laws of the country where the property is located. For example, a timeshare in Mexico is governed by Mexican law, which may not recognize U.S. disclaimers. You’ll need legal advice from a lawyer licensed in that country. Some resorts may still pursue the estate for unpaid fees, even across borders.

Is there a government program to help with unwanted timeshares?

No. There are no federal or state government programs that help heirs escape timeshare debt. Any company claiming to offer “free help” from the government is a scam. Stick to licensed estate attorneys or reputable exit companies with verified BBB ratings.

Corbin Fairweather

I am an expert in real estate focusing on property sales and rentals. I enjoy writing about the latest trends in the real estate market and sharing insights on how to make successful property investments. My passion lies in helping clients find their dream homes and navigating the complexities of real estate transactions. In my free time, I enjoy hiking and capturing the beauty of landscapes through photography.

view all postsWrite a comment