Shared Ownership Cost Calculator

Calculate your monthly housing costs for shared ownership properties. Input the property value, your share percentage, mortgage rate, and rent percentage to see your estimated monthly costs.

Enter values above to calculate your costs

Staircasing Cost Estimate

How much will it cost to increase your share by 10%?

Note: This includes valuation fees, legal fees, and potential mortgage costs

When you hear "shared ownership," you might think you’re renting half a house and buying the other half. But that’s not quite how it works. The share ownership structure is the legal and financial framework that lets you buy a portion of a home-usually between 25% and 75%-while paying rent on the rest. It’s not a co-ownership deal with another person. It’s you and a housing association, and the rules around it are tighter than most people realize.

How the Share Ownership Structure Works

You don’t own the whole property. Instead, you own a share-say, 40%-and the housing association owns the remaining 60%. You pay a mortgage on your share and rent on the part you don’t own. The rent isn’t set by the market. It’s calculated as a percentage of the housing association’s share, usually around 2.75% to 3% per year. So if your home is worth $400,000 and you own 40%, you pay rent on the $240,000 they hold. That’s about $600 a month in rent, plus your mortgage payment on your $160,000 share.

This structure was designed to help people who can’t afford a full deposit or mortgage. You might only need a 5% deposit on your share, not the full property. So instead of $80,000 for a 20% deposit on a $400,000 home, you’d only need $8,000 for your 40% share. That’s the big draw.

Who Owns the Rest?

The non-share part is owned by a registered social landlord-usually a housing association or sometimes a local council. These aren’t private investors. They’re nonprofit organizations regulated by the government. Their job isn’t to make money off you. It’s to provide affordable housing. That’s why they set the rent at a fixed rate, not a market rate. They also handle repairs, building insurance, and major maintenance. You’re responsible for minor things like fixing a leaky tap or replacing a broken window.

You can’t sell your share to just anyone. The housing association has the right to find a buyer first. If they can’t find someone within a set time (usually eight weeks), you can list it publicly. But you still have to sell at market value. No discounts, no private deals. The housing association takes a cut too-typically 1% to 2% of the sale price-to cover their admin costs.

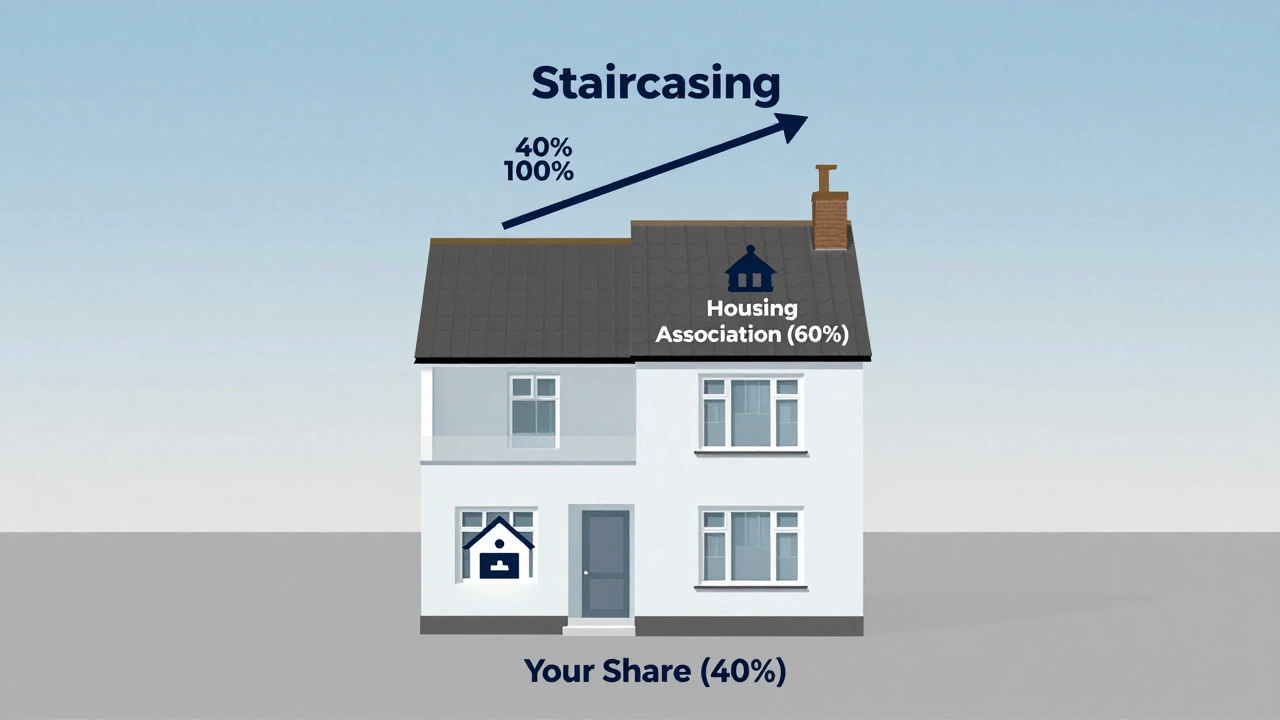

Staircasing: Buying More Shares Over Time

One of the most misunderstood parts of shared ownership is staircasing. That’s the process of buying more shares in your home over time. You can usually buy in increments of 10% or more, depending on your housing association’s rules. Each time you staircase, you pay for a new valuation. That’s important. If your home’s value went up, you pay more for the next share. If it dropped, you pay less. It’s not fixed.

Let’s say you started with 40% of a $400,000 home. After three years, it’s worth $450,000. You decide to buy another 25%. You pay 25% of $450,000-that’s $112,500-not $100,000. You also need to cover legal fees, valuation fees, and possibly higher mortgage costs. Some people staircase all the way to 100%. Others stop at 75% because the rent on the remaining 25% is low enough that it’s not worth the extra cost.

There’s a catch: once you hit 100%, you’re no longer in shared ownership. You’re a full homeowner. But you still might owe the housing association a fee to remove their legal interest from the title. That’s called a "deed of surrender." It can cost $500 to $1,500, depending on your region.

What Happens If You Can’t Afford to Staircase?

Not everyone can keep buying more shares. Life happens. A job loss, a medical bill, a divorce. If you can’t afford to staircase, you don’t lose your home. You just stay at your current share level. Your rent stays the same. Your mortgage stays the same. You’re not penalized for not upgrading.

But you also can’t sell your share back to the housing association unless you’re moving out. They don’t buy shares back. They only help you find a buyer. If you’re stuck and can’t sell, you’re stuck. That’s why it’s critical to plan ahead. Talk to your housing association early. Ask about their policies on financial hardship. Some offer payment plans or temporary rent reductions.

Can You Get a Mortgage for Shared Ownership?

Yes, but not every lender offers it. Only certain banks and building societies have shared ownership mortgage products. These are different from regular mortgages. They’re based on the value of your share, not the whole property. Lenders also look at your rent payments as part of your monthly outgoings. So if you pay $600 rent and $800 mortgage, they treat your total housing cost as $1,400 when assessing affordability.

Interest rates are usually higher than standard mortgages. That’s because lenders see shared ownership as riskier. Your equity is smaller, and resale is more complicated. You’ll need a deposit of at least 5% of your share. Some lenders require 10%. You’ll also need a good credit score and proof of stable income. Self-employed people face more hurdles.

What About Ground Rent and Service Charges?

Shared ownership homes often come with ground rent and service charges. Ground rent is a small annual fee paid to the freeholder. In many cases, the housing association owns the freehold, so this fee is minimal-sometimes just $1 to $5 per year. Service charges cover things like building insurance, cleaning of common areas, lift maintenance, or landscaping. These can range from $100 to $400 a year, depending on the building.

Some newer shared ownership properties have escalating ground rents. That means the fee doubles every 10 years. This used to be common in private developments, but most housing associations now cap ground rent at a fixed amount. Always check the lease before signing. If you see a ground rent that increases over time, walk away unless you fully understand the long-term cost.

What’s the Difference Between Shared Ownership and Shared Equity?

People mix these up all the time. Shared ownership is when you own a share and pay rent on the rest. Shared equity is different. In shared equity, you take out a mortgage for 100% of the property, but the government or a third party gives you an interest-free loan for part of the deposit. You don’t pay rent. You just repay the loan when you sell. Shared equity is only available in certain regions and usually for first-time buyers under a government scheme.

In New Zealand, shared equity schemes are rare. Most shared ownership models here are run by housing associations under the Housing Corporation Act. The rules are different from the UK, where shared ownership is more common. In New Zealand, you won’t find the same level of government-backed support. That makes it harder to get in, but also less risky in the long run.

Is Shared Ownership Right for You?

It’s a good option if you’re a first-time buyer who can’t save for a full deposit. It’s also good if you expect your income to rise in the next few years and want to build equity slowly. But it’s not ideal if you plan to move in five years. Selling a shared ownership home takes longer, and you might not recoup your costs if the market dips.

Ask yourself: Can I afford the rent and mortgage together? Do I want to be tied to one property for the long term? Am I okay with rules about renovations, pets, or subletting? Most housing associations don’t allow subletting. Some limit how much you can alter the property. You need to read the lease carefully.

What Happens When You Die?

Your share in the property becomes part of your estate. You can leave it to your partner, child, or anyone in your will. The housing association doesn’t take it back. But the new owner must meet the same eligibility rules you did. If they can’t afford the mortgage or rent, they might have to sell. If they’re a family member who already lives in the home, they can usually take over the lease without reapplying.

It’s worth writing a will and telling your family how shared ownership works. Many people don’t realize their loved ones can inherit a partial home-and that comes with responsibilities.

Final Thoughts

The share ownership structure isn’t perfect. It’s bureaucratic, slow, and full of fine print. But for thousands of people in Auckland and across New Zealand, it’s the only way to get a foot on the property ladder. It doesn’t give you full control, but it gives you stability. You’re not renting forever. You’re building something-piece by piece.

If you’re considering it, talk to your local housing association. Ask for a copy of their shared ownership guide. Read the lease. Get independent legal advice. Don’t rush. This isn’t just a home purchase. It’s a long-term commitment with rules you can’t change.

Can I sell my shared ownership home anytime?

You can list your share for sale at any time, but the housing association has the first right to find a buyer. They typically have eight weeks to do this. If they don’t, you can market it publicly. But you must sell at market value, and the buyer must qualify for shared ownership. You can’t just sell to anyone.

Do I pay stamp duty on shared ownership homes?

In New Zealand, there is no stamp duty. However, you’ll pay legal fees, valuation fees, and possibly land transfer fees when you buy your share or staircase. These costs can add up to $2,000-$4,000 depending on the property value and your share size.

Can I rent out my shared ownership home?

Almost always, no. Most housing associations prohibit subletting in shared ownership agreements. The purpose is to help owner-occupiers, not investors. If you need to move away, you usually have to sell your share. Some exceptions exist for temporary relocations due to work or health, but you must get written permission first.

What if my home’s value drops after I buy my share?

If your home’s value drops, you still pay rent based on the housing association’s share at the time of your last valuation. When you staircase, you’ll pay less for the next share because the valuation is lower. You don’t owe more just because the market fell. But if you sell later, you might lose money on your investment.

How long does it take to staircase to 100%?

There’s no set timeline. Some people staircase in three years. Others take 10 or more. It depends on your income, how much you can save, and how much your home appreciates. Most people staircase in stages-first to 50%, then 75%, then 100%. Each step requires a new valuation and legal process, which can take 6-12 weeks per stage.

Corbin Fairweather

I am an expert in real estate focusing on property sales and rentals. I enjoy writing about the latest trends in the real estate market and sharing insights on how to make successful property investments. My passion lies in helping clients find their dream homes and navigating the complexities of real estate transactions. In my free time, I enjoy hiking and capturing the beauty of landscapes through photography.

view all postsWrite a comment