Home Loan Credit Score Calculator

Calculate Your Home Loan Eligibility

Enter your credit score to see how it affects your mortgage options in New Zealand

If you're a first-time buyer in New Zealand, you’ve probably asked yourself: What credit score is needed to buy a house? The answer isn’t a single number-it’s a mix of factors, but your credit score is one of the biggest gatekeepers. Most lenders in New Zealand won’t even look at your application if your score is below 500. But even if you’re above that, your interest rate, deposit requirement, and approval odds change dramatically depending on where you land between 500 and 850.

How Credit Scores Work in New Zealand

In New Zealand, credit scores are calculated by three main agencies: Equifax, Illion, and Centrix. Each uses slightly different data, but they all look at the same core things: how often you pay bills on time, how much debt you carry, how long you’ve had credit, and how many times you’ve applied for loans or credit cards recently.

Your score ranges from 0 to 1200. A score of 700+ is considered good. 800+ is excellent. But here’s the thing: lenders don’t all use the same scale. Some banks use their own internal scoring models, but they still rely heavily on these three agencies’ data. So if you’ve got a 720 from Equifax, you’re in a strong position. If you’re at 580, you’re going to struggle unless you have a huge deposit or a co-signer.

Minimum Credit Score for a Home Loan in 2026

There’s no official government minimum credit score to buy a house in New Zealand. But in practice, here’s what banks are doing right now:

- Below 500: Almost no lender will approve you. You’ll be declined before they even look at your income or deposit.

- 500-649: Possible, but only with a very large deposit (40% or more), a guarantor, or through a specialist lender. Expect interest rates 1.5%-3% higher than standard.

- 650-749: You’ll qualify for most mainstream lenders. You might need a 10%-20% deposit. Rates are competitive, but not the best.

- 750-850: You’ll get the lowest rates, smallest deposit requirements (as low as 5% with some government-backed schemes), and faster approvals.

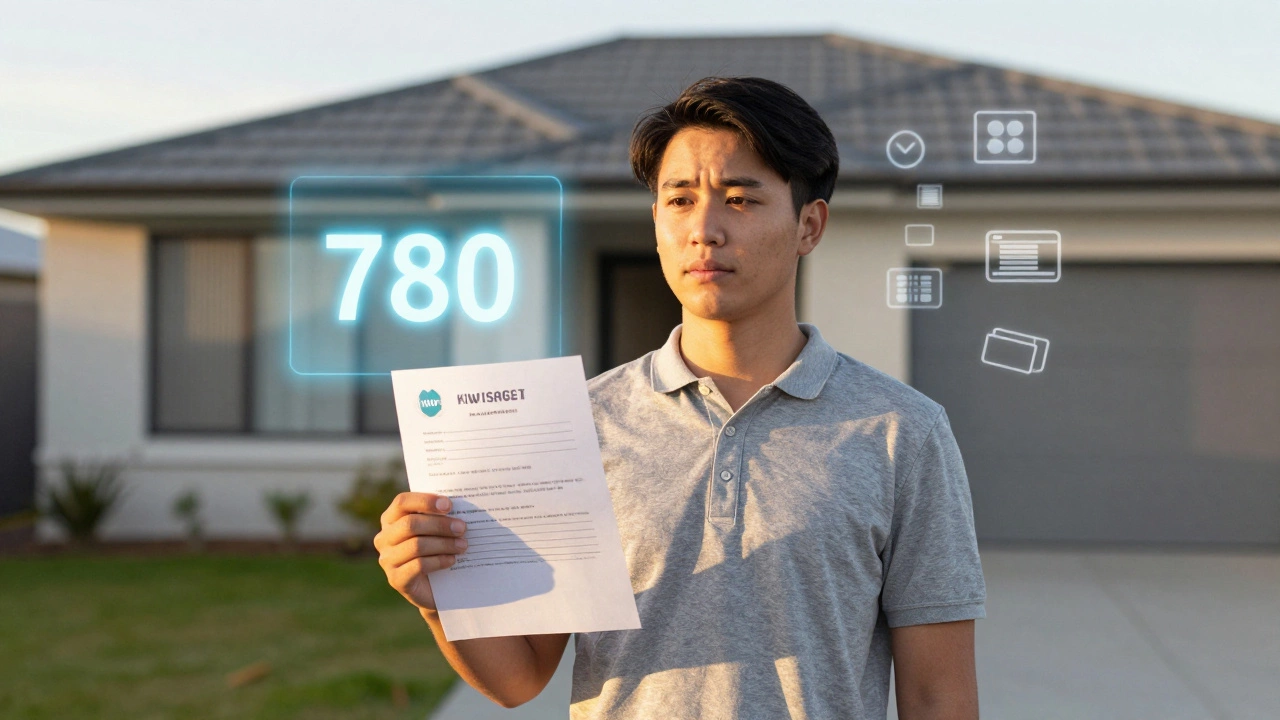

For example, in late 2025, KiwiSaver first-home buyers with scores above 780 were getting 3.1% fixed rates on 25-year loans. Those with scores under 600 were being offered 5.8%-a difference of over $200 a month on a $500,000 mortgage.

Why Your Credit Score Matters More Than Ever

Since 2023, Reserve Bank rules have made lenders much stricter. They now have to prove you can handle higher interest rates if they rise again. That means they look harder at your credit history. A single late payment in the last 12 months can cost you thousands in extra interest-or get you turned down entirely.

Here’s what lenders see when they check your score:

- Are you paying your phone, electricity, or internet bills on time? (These now count.)

- Have you maxed out your credit cards? (Lenders hate utilization over 50%.)

- Have you applied for 3 or more loans in the last 6 months? (That’s a red flag.)

- Do you have any defaults, collections, or bankruptcies? (Even if paid, they stay on file for 5 years.)

One client I worked with in Auckland had a $120,000 deposit and a steady $90,000 salary. She was declined by three banks because she had a $200 overdue power bill from 18 months ago that she’d paid-but it still showed up as a ‘minor default.’ She got approved on the fourth try after she got a letter from the power company confirming it was resolved and submitted it with her application.

How to Improve Your Credit Score Fast

You don’t need to wait a year to fix your score. Here’s what actually works in 2026:

- Check your report for free-go to Equifax or Illion and request your full report. Look for errors like accounts you didn’t open or payments marked late that weren’t.

- Pay every bill on time-even small ones. Set up auto-pay for your phone, Netflix, and utilities. These now affect your score.

- Reduce credit card balances-aim to use less than 30% of your limit. Pay off $500 on a $2,000 card, and your score can jump 40-60 points in 30 days.

- Don’t open new credit-no new credit cards, store financing, or personal loans for at least 6 months before applying for a mortgage.

- Get on the electoral roll-it’s not optional. If you’re not registered to vote, your score drops automatically.

One first-time buyer in Hamilton boosted his score from 592 to 731 in 90 days just by doing those five things. He got his first home offer accepted within a week.

What If You Don’t Have a Credit History?

Some young buyers-especially those who’ve never had a credit card, loan, or even a mobile phone contract-have no credit score at all. That’s called being “credit invisible.”

It’s not impossible to get a loan, but you’ll need to prove your reliability another way. Lenders may ask for:

- 12-24 months of bank statements showing consistent rent payments

- Letters from landlords confirming on-time payments

- Proof of regular savings (e.g., $500/month deposited for a year)

- Proof of stable employment (2+ years in the same job)

Some lenders, like SBS Bank and Co-operative Bank, have special programs for credit-invisible buyers. They don’t rely on credit scores-they look at your cash flow instead.

Government Help for First-Time Buyers

If your score is between 650 and 750, you might qualify for the First Home Loan or First Home Grant. These programs let you buy with as little as 5% deposit if you meet income caps and are buying a home under the price threshold (which varies by region).

But here’s the catch: even with government help, your credit score still matters. If your score is under 600, you won’t qualify for the First Home Loan-even if your income is perfect. The government partners with the same banks that use Equifax and Illion. No exceptions.

What Happens After You Get Approved?

Getting approved is just the start. Your credit score continues to matter after you buy. If you miss a payment in your first year, your lender can re-assess your loan. In extreme cases, they can demand you pay more or refinance at a higher rate.

Keep your score healthy by:

- Never missing a mortgage payment

- Keeping credit card use low

- Not applying for new loans or car finance in the first 12 months

One couple in Tauranga bought their first home with a 720 score. They celebrated by opening a new credit card to get a free flight. Three months later, their mortgage rate went up by 0.7% because their credit utilization spiked. They didn’t realize it would affect their home loan.

Final Thoughts

There’s no magic number-but if you’re aiming to buy a house in 2026, treat your credit score like your deposit. It’s not just a number. It’s your ticket to better rates, lower deposits, and less stress. Start checking your score now. Fix mistakes. Pay down debt. Don’t open new credit. And don’t wait until you’re ready to buy to fix it-fix it six months before you start looking.

Most first-time buyers think they need a perfect score. They don’t. But they do need a score that shows lenders they’re responsible. That’s not hard. It just takes a few smart moves.

Can I buy a house with a credit score of 550 in New Zealand?

It’s extremely difficult. Most mainstream lenders won’t approve you with a score under 500-550. You might qualify with a specialist lender or if you have a 40%+ deposit and a guarantor, but you’ll pay significantly higher interest rates-often over 6%. It’s better to improve your score first.

How long does it take to improve a credit score?

You can see improvements in as little as 30 days if you pay down credit card balances and fix errors. But to reach a score of 700+ from below 600, most people need 6-12 months of consistent on-time payments and low credit use.

Does checking my credit score hurt it?

No. Checking your own score is a soft inquiry and doesn’t affect it at all. You can check it as often as you like for free through Equifax, Illion, or Centrix. Only hard inquiries-when lenders check your score during an application-can lower it slightly.

Do utility bills affect my credit score?

Yes. Since 2023, on-time payments for phone, internet, electricity, and water bills are now reported to credit agencies. Late or missed payments can hurt your score. Setting up auto-pay helps.

Can I get a home loan without any credit history?

Yes, but it’s harder. Some banks like SBS and Co-operative Bank accept proof of rent payments, savings history, and steady employment instead of a credit score. You’ll need 12-24 months of bank statements and letters from landlords to prove reliability.

Corbin Fairweather

I am an expert in real estate focusing on property sales and rentals. I enjoy writing about the latest trends in the real estate market and sharing insights on how to make successful property investments. My passion lies in helping clients find their dream homes and navigating the complexities of real estate transactions. In my free time, I enjoy hiking and capturing the beauty of landscapes through photography.

view all postsWrite a comment