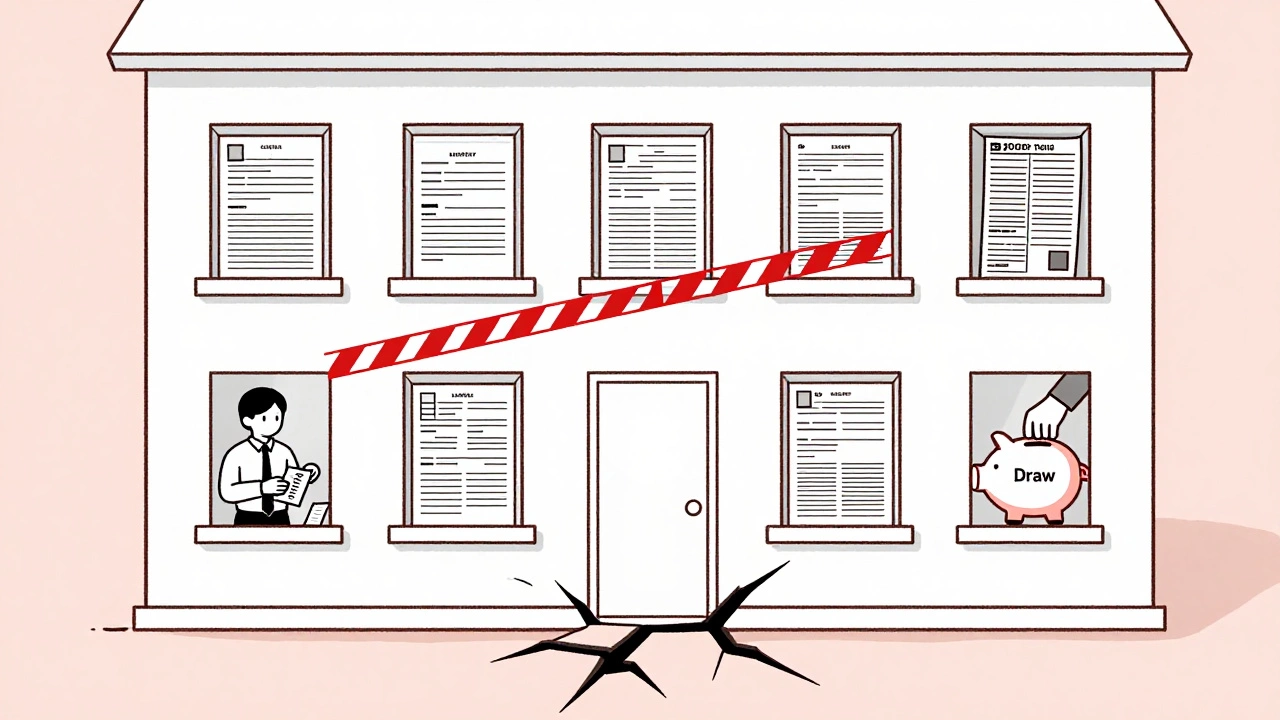

When you co-own a home with others - whether it’s through a housing cooperative, community land trust, or shared equity arrangement - how you pay yourself matters. Not just for your bank account, but for taxes, legal liability, and long-term stability. The big question isn’t just owner's draw or salary - it’s which one keeps your arrangement fair, legal, and sustainable.

What’s the difference between owner’s draw and salary?

An owner’s draw is money you take out of the business or co-ownership entity for personal use. It’s not a wage. It’s a withdrawal from your equity share. Think of it like pulling cash from your own savings account - you’re not being paid by the company, you’re just accessing your own money.

A salary, on the other hand, is a fixed, regular payment for work you do. It’s treated like any employee’s paycheck: taxed at source, subject to payroll deductions, and recorded as an expense on the books.

In a shared ownership setup, you might be managing repairs, handling tenant screening, or doing bookkeeping. If you’re doing that work, you’re not just an owner - you’re an employee too. That’s where the confusion starts.

Why most shared ownership groups pick salary

In New Zealand, the Inland Revenue Department (IRD) expects people who perform services for a co-owned property entity to be paid fairly. If you’re managing the property full-time - collecting rent, organizing maintenance, dealing with council rules - you’re providing labor. And labor has a cost.

Most successful shared ownership groups in Auckland pay a salary because it’s cleaner. It creates a clear paper trail. It protects everyone from tax audits. It also makes it easier to bring in new members later. If someone joins the co-op, they can see exactly how much time and money each person is putting in.

Take the example of a five-person co-op in Mt Roskill. Each member owns 20%. One person handles all the admin. They don’t take a draw - they take a $450/month salary. That’s documented in the co-op’s bylaws. Everyone pays their share of the salary through their monthly fees. No one’s confused. No one’s worried about uneven withdrawals.

When owner’s draw makes sense

Owner’s draw works best when you’re not doing active work. Maybe you’re a passive investor - you put in cash, you get a share of the equity, and you don’t lift a finger. In that case, taking a draw from profits is fine.

But here’s the catch: if you’re taking draws while also doing work, the IRD could reclassify those draws as salary. That means you owe PAYE, ACC levies, and possibly GST if you’re registered. And if you didn’t withhold those taxes, you’re on the hook for penalties and interest.

There’s also a fairness issue. If one person takes $10,000 in draws over the year while others take nothing, even though everyone does the same amount of work, resentment builds. Salaries level the playing field. Draws don’t.

Tax implications you can’t ignore

In New Zealand, owner’s draws aren’t taxed at the time you take them. But they reduce your equity, which affects capital gains later. If you sell your share, the profit is calculated based on what you originally put in minus what you took out. That can make your taxable gain bigger than expected.

Salaries, however, are taxed as income. You pay PAYE, KiwiSaver, and ACC. But you also get a tax deduction for the co-op - the salary is an allowable expense. That lowers the group’s overall taxable income.

Let’s say your co-op makes $30,000 in net profit after expenses. If you take $15,000 as a draw, the whole $30,000 might still be subject to tax under the co-op’s structure. But if you pay yourself $15,000 as salary, the co-op only reports $15,000 in profit - and you pay tax on your salary separately. That can save the group hundreds or even thousands in tax.

Legal and compliance risks

Shared ownership isn’t a free-for-all. If your group is registered as a company, a trust, or even a limited partnership, you’re bound by rules. Taking irregular draws without documentation can look like money laundering or tax evasion - even if that’s not your intent.

The IRD has been cracking down on informal arrangements in co-ops and housing collectives. In 2024, they issued guidance specifically warning groups that “personal benefits disguised as equity withdrawals” are being reviewed. If you’re taking draws without payroll records, you’re already on their radar.

Plus, if someone in your group ever needs to apply for a benefit, loan, or visa, they’ll need to prove their income. A salary shows up on payslips. A draw? It doesn’t. That can block access to housing subsidies, student loans, or even mortgage approvals.

What the experts recommend

Most legal and accounting advisors in Auckland who specialize in shared ownership say: pay yourself a salary if you’re working. Take draws only if you’re not doing work - and even then, keep it predictable and documented.

Here’s what a solid setup looks like:

- Define roles in writing: who does what, how many hours per week.

- Set a fair market rate for that work - check TradeMe for property manager rates in your area.

- Pay that as a monthly salary, with payslips and payroll records.

- Use any leftover profit for reserves, repairs, or dividends - not personal draws.

- Review the arrangement every 12 months. Adjust for inflation, workload changes, or new members.

One co-op in Ponsonby started with draws. After two years, they got an IRD letter asking for back PAYE. They ended up paying $8,700 in penalties and interest. Now they pay salaries. Their monthly meetings are calmer. Their tax bills are lower. And their new member application process is smooth.

What if you can’t afford a salary?

Some groups struggle because the property doesn’t generate enough income. That’s real. But that doesn’t mean you should take draws instead.

Instead, adjust the model:

- Reduce your hours - split the work between members.

- Outsource one task - like bookkeeping - for $50/month instead of doing it yourself.

- Apply for government grants for community housing. Many are available for co-ops in Auckland.

- Use a sliding scale: if rent income rises, so does your salary.

There’s no shame in starting small. What you can’t afford now, you can build toward. But don’t confuse financial strain with legal permission.

Final rule: Be transparent, be consistent

Shared ownership only works when everyone trusts the system. Draws feel flexible. But flexibility without rules creates chaos. Salaries feel rigid. But rigidity with fairness builds trust.

Write it down. Share it with everyone. Stick to it. That’s the real secret to making shared ownership last.

Can I take both a salary and an owner’s draw?

Technically, yes - but only if you’re doing two separate things. For example, if you’re paid a salary for managing the property and also receive a small draw from leftover profits that’s distributed equally to all owners, that’s acceptable. But if you’re taking a draw on top of a salary for the same work, the IRD will likely treat the draw as undeclared salary. Keep them clearly separated and documented.

Do I need to register for GST if I take a salary?

No, not because of your salary. GST applies to the co-op’s income, not your personal pay. If your co-op’s annual turnover is under $60,000, you don’t need to register for GST. If you’re collecting rent and your total income from the property exceeds that, then the co-op may need to register - not you individually. Always check with an accountant familiar with co-ops.

What happens if I don’t pay myself at all?

If you’re doing all the work and taking nothing, that’s unsustainable. Eventually, you’ll burn out. Or worse - someone else will start doing the work and expect to be paid. It creates imbalance. Even if you’re not taking cash, you should record your time as an in-kind contribution. That protects your equity stake if the group ever sells or restructures.

Can I use owner’s draw to pay for personal expenses like my car or groceries?

If you’re using co-op funds for personal costs without a salary structure, you’re mixing personal and shared finances. That’s a red flag for the IRD and can void your co-op’s legal protection. If you need to cover personal expenses, get paid a salary first. Then use your personal income like anyone else. Keep the co-op’s money in the co-op’s account.

How do I prove my income if I only take owner’s draws?

You can’t - not reliably. Banks, landlords, and government agencies need payslips, bank statements showing regular deposits, or tax returns with employment income. Draws don’t show up as income. If you’ve been relying on draws, start transitioning to a salary now. Even a small, consistent monthly payment builds a track record. It’s the only way to access housing support, loans, or tenancy applications in the future.

Next steps: What to do today

Don’t wait for a tax notice. Start fixing this now:

- Call a meeting with your co-owners. Ask: “Are we paying for work done? Or just taking money out?”

- Write down every task someone does - even small ones like paying the water bill or calling the plumber.

- Look up average pay for property managers in Auckland. Use that as a baseline.

- Agree on a monthly salary amount - even if it’s $200. Document it in writing.

- Start paying it. Use a simple payroll app or spreadsheet. Keep records.

- Review every six months. Adjust as rent, costs, or workload changes.

Shared ownership is about fairness. Paying yourself properly isn’t greedy - it’s how you make the system work for everyone.

Corbin Fairweather

I am an expert in real estate focusing on property sales and rentals. I enjoy writing about the latest trends in the real estate market and sharing insights on how to make successful property investments. My passion lies in helping clients find their dream homes and navigating the complexities of real estate transactions. In my free time, I enjoy hiking and capturing the beauty of landscapes through photography.

view all postsWrite a comment