Property Share Affordability Calculator

Calculate your monthly costs for shared ownership properties. Enter property price, share percentage, and mortgage rate to see if you can afford this option.

Monthly Costs Breakdown

Staircasing Timeline

Estimating time to reach 100% ownership based on additional monthly payments

Ever wonder how you can own a slice of a house without paying the full price upfront? Property shares let you buy a percentage of a home and rent the rest, making homeownership more affordable for many people.

- Buy a share (usually 25‑75%) of a property and pay rent on the remaining portion.

- Pay a mortgage on your share and a service charge on the whole building.

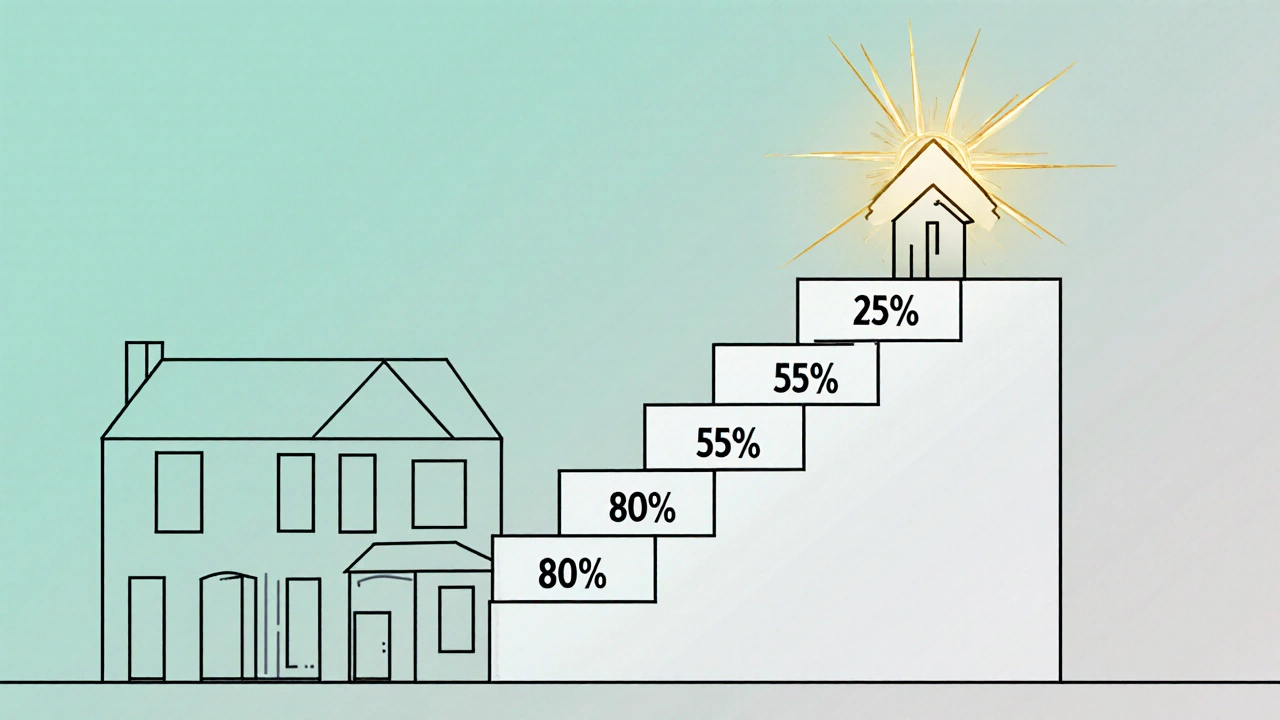

- Increase your ownership over time through a process called “staircasing.”

- Eligibility often depends on income limits and first‑time‑buyer status.

- Resale values follow market trends, but you’ll need permission from the housing provider.

What Is a Property Share?

In the UK, a Property share is a type of shared ownership agreement where you purchase a proportion of a home and pay rent on the remainder. It’s designed to bridge the gap between renting and owning outright.

How the Financials Break Down

When you purchase a property share, three main costs hit your wallet each month:

- Mortgage - you borrow money to fund the share you own.

- Rent - you pay rent to the owner of the unsold share, usually a housing association.

- Service charge - covers building maintenance, insurance, and communal area costs.

The rent is calculated as a percentage of the market rent for the whole property, so if you own 50% you’ll pay rent on the other 50%.

Eligibility and Who Can Apply

Most schemes target first‑time buyers with household incomes below a set threshold (often £80,000 in England, £60,000 in London). You’ll also need a good credit score for the mortgage portion.

Housing associations and some local councils act as the housing association, the entity that retains the unsold share. They often run the eligibility checks and provide the lease agreement.

Step‑by‑Step: Getting a Property Share

- Search for eligible homes. Use the shared‑ownership portal on the housing association’s website or a specialist real‑estate website.

- Calculate affordability. Plug the purchase price, expected mortgage rate, and rent into an online affordability calculator to see if you can meet the monthly outgoings.

- Apply for the share. Submit an application form with proof of income, credit report, and identification.

- Secure a mortgage. Approach a lender experienced with shared‑ownership mortgages; they’ll assess the share value, not the whole property.

- Sign the lease. The housing association provides a lease for the portion you don’t own, detailing rent, service charge, and staircasing rights.

- Move in. Once the mortgage is approved and the lease signed, you become a legal owner of your share.

Pros and Cons of Property Shares

| Pros | Cons |

|---|---|

| Lower deposit (as low as 5% of the share price). | Rent on the unsold portion can feel like double payment. |

| Staircasing lets you increase ownership over time. | Resale requires approval from the housing provider. |

| Eligibility helps first‑time buyers enter the market. | Service charges apply to the whole building, even if you own a small share. |

| Potential for capital growth as property values rise. | Mortgage rates may be higher for shared‑ownership loans. |

Property Share vs Buying Outright vs Renting

| Factor | Property Share | Full Purchase | Renting |

|---|---|---|---|

| Initial cash needed | 5‑15% of share price | 5‑20% of full price | Deposit + first month’s rent |

| Monthly cost | Mortgage + rent + service charge | Mortgage only (plus service charge) | Rent + utilities |

| Equity build‑up | Builds as you staircase | Full equity from day one | No equity |

| Flexibility to move | Can sell share, subject to approval | Can sell any time (market dependent) | Can end tenancy with notice |

| Eligibility limits | Income caps, first‑time‑buyer status | None (aside from mortgage qualification) | None |

Common Pitfalls and How to Avoid Them

Underestimating total costs. Many buyers focus on the deposit and mortgage, forgetting rent and service charges. Use a spreadsheet to add all monthly outgoings before you commit.

Missing staircasing windows. Housing providers usually allow you to buy more shares every few years. Keep an eye on market values and budget for the extra mortgage payment.

Ignoring lease restrictions. Some leases forbid subletting or limit renovations. Read the lease carefully or ask a solicitor to highlight red flags.

Choosing the wrong provider. Not all housing associations offer the same support. Compare their customer service ratings, fee structures, and resale policies.

Tips for a Smooth Experience

- Get a pre‑approval mortgage before you start house hunting.

- Ask the housing association about future rent‑increase caps.

- Consider a joint purchase with a partner to boost your share size.

- Plan for staircasing by setting aside extra savings each year.

- Use a solicitor experienced in shared‑ownership transactions to avoid hidden costs.

Frequently Asked Questions

Can I rent out the part of the house I own?

Most leases forbid subletting without written permission from the housing association. Breaching this clause can lead to eviction.

What happens if the property value drops?

Your share’s value follows the market, so a decline means you may owe more on the mortgage than the share is worth. However, you can usually refinance or wait for the market to recover.

Is there a limit to how much of the property I can own?

Most schemes cap ownership at 75% or 80%. To reach 100%, you must buy the remaining share from the housing association, often at market price.

Do I need a separate mortgage for the rent portion?

No. The rent is paid directly to the housing association, while the mortgage covers only the share you own.

Can I switch to a different housing association later?

Changing providers is rare because each lease is tied to a specific association. You’d need to sell your share and re‑enter a new scheme.

Corbin Fairweather

I am an expert in real estate focusing on property sales and rentals. I enjoy writing about the latest trends in the real estate market and sharing insights on how to make successful property investments. My passion lies in helping clients find their dream homes and navigating the complexities of real estate transactions. In my free time, I enjoy hiking and capturing the beauty of landscapes through photography.

view all postsWrite a comment