People live in luxury apartments not just for status, but for time saved, security, smart design, and peace of mind. It’s about reclaiming control over daily life in a crowded world.

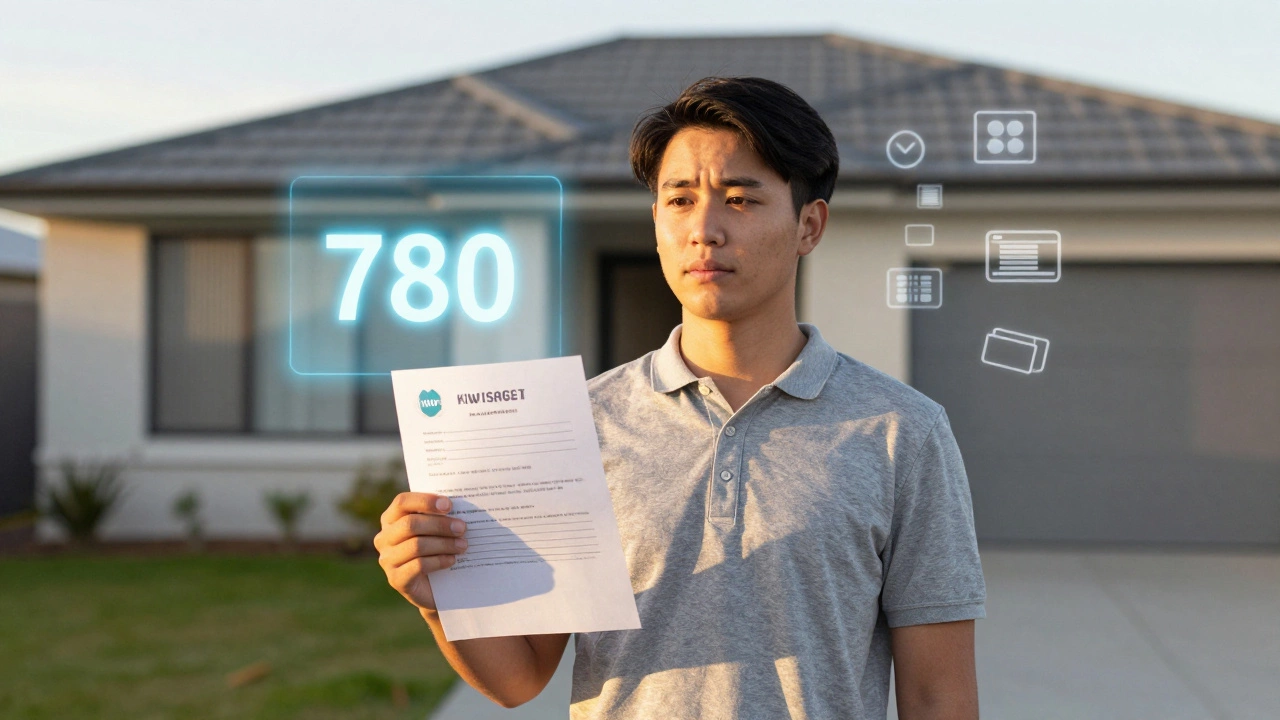

Find out the real credit score needed to buy a house in New Zealand as a first-time buyer in 2026. Learn how to improve your score fast and avoid common mistakes that cost you thousands.

The minimum credit score for an FHA loan is 500, but most lenders require 580 or higher to get the lowest 3.5% down payment. Learn what score you really need and how to improve it fast as a first-time buyer.

The 50% rule in rental property helps investors estimate operating expenses. It says half your rent will go to repairs, insurance, management, and vacancies-before mortgage payments. A simple way to avoid losing money on buy-to-let investments.

Luxury housing in 2026 is defined by thoughtful design, premium materials, and seamless functionality-not size or price. Discover what truly makes a high-end home feel luxurious.

Learn how to legally access your equity as a shared ownership homeowner - through staircasing, remortgaging, or selling your share - without breaking housing association rules.

A share of ownership in a shared ownership home is called an equity share. It lets you buy part of a property while paying rent on the rest, offering a path to homeownership without needing a full deposit.

Fractional ownership offers access to luxury homes without full-price ownership, but hidden fees, inflexible scheduling, and poor resale value make it a risky choice for most buyers.

In shared ownership homes, choosing between owner's draw and salary affects taxes, fairness, and legal compliance. Learn why salary is usually the smarter, safer choice for co-owners doing work.

Asking to bring your dog to someone's house isn't rude - but how you ask is everything. Learn the right way to request pet access, why renters need to be extra careful, and what to do when the answer is no.

Learn how to qualify as a first-time home buyer in North Carolina, including income limits, down payment assistance, credit requirements, and step-by-step eligibility rules for 2025.

ESOP shared ownership schemes may seem like an affordable path to homeownership, but hidden fees, limited control, and risky resale terms can trap buyers. Learn why this model often costs more than it saves.